America is unqualified to preach debt sustainability

Is this a nation that is suited to preach debt management and sustainability on the world stage? Developing countries demand answers.

-

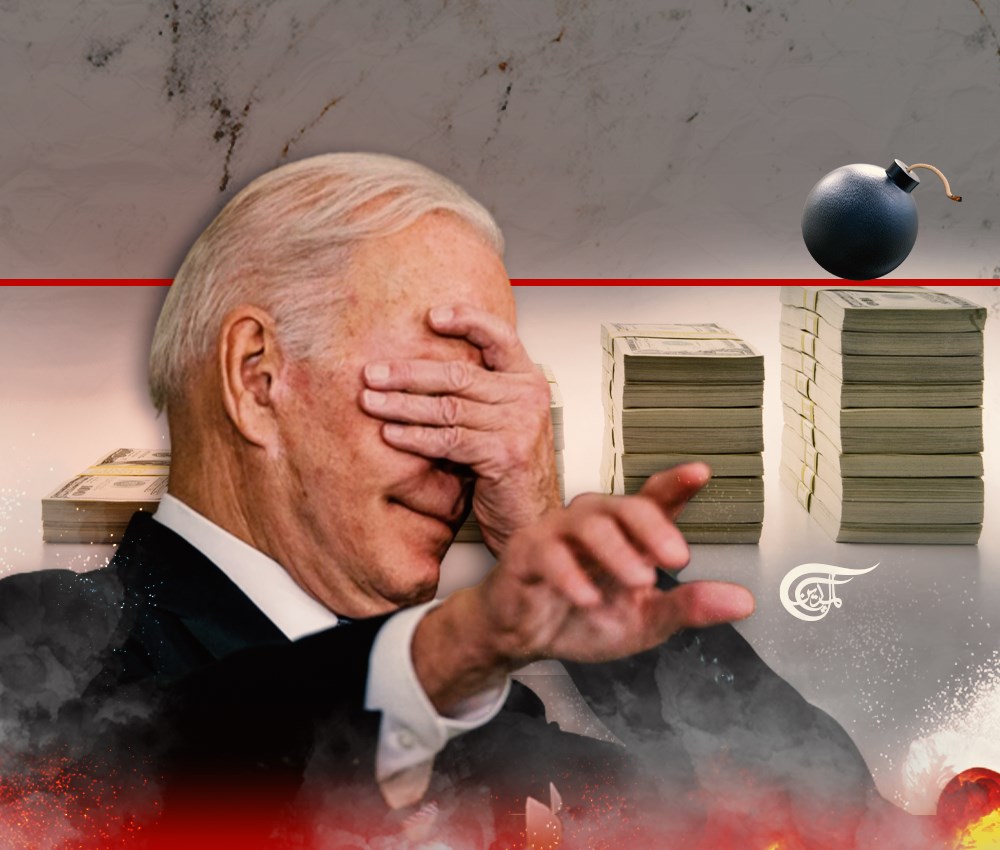

Biden is too busy marketing a narrative of winning over Congress and bringing the US economy to stable shores, revealing the gaps in his own economic governance track-record.

The United States continues to accumulate substantial debt and that too at an alarming pace. Its growth overconfidence and a dearth of sustainable planning has made clear that the risk of default won’t leave the economy anytime soon. It reflects in the likelihood that the US – according to the Congressional Budget Office (CBO) – will exhaust its ability to pay all its bills later in the year. Amid such a shambolic turnaround, President Joe Biden wants scores of countries in the developing world to still follow US advice on how to manage their debt levels, when peak ignorance is amply evident at home.

“CBO estimates that under its baseline budget projections, the Treasury would exhaust those measures and run out of cash sometime between July and September of this year,” read an estimate in a new report. Make no mistake: following U.S. footsteps is a recipe for economic self-harm.

Sharp opposition to raising America’s “debt ceiling” firmly exposes the polarizing politics of keeping national interest at bay. Washington’s failure to project the reality of its flailing economy to the world is captured through this polarizing debate that has sent markets on edge, and rendered millions of Americans an afterthought. After all, for months the Biden administration has also led calls to caution modest economies as far as Africa to heed US guidance on so-called “debt trap.” Also, the underlying incentive is to force them to embrace America’s assistance in the process. Now that same American economy is trapped in a heated internal debate about settling the debt-ceiling debate. In any other government that responds to reason, catering to the interests of the masses would be a no-brainer.

Still, the nation that is most willing to lead developing nations out of the shadow of debt is the same country that breached its $31.4 trillion borrowing limit about a month ago. A veneer of democracy dominates the American Congress as well, given its unwillingness to arrive at a solution and give Biden’s shambolic economic governance a clear pass. In short, a democracy in crisis offers no silver lining on debt sustainability to countries in need.

Interestingly, it is a fact that several modest economies in the wider Pacific have been consciously courted by the US under the garb of economic coercion. That includes some underperforming Pacific Island economies that are rightly skeptical of US geopolitical interests and economic doublespeak, and cannot bank on US debt advice to see them through. Consider the current US debt ceiling crisis as a warning: there is a conscious attempt to risk the country’s slide towards debt default as feuding politicians indulge in point-scoring. Toxic opposition rhetoric from key Republican party leaders makes that point fundamentally clear. Lawmakers are prioritizing their resistance to Biden to keep an anti-default consensus out of reach for now.

All this begs the question: Is this a nation that is suited to preach debt management and sustainability on the world stage? Developing countries demand answers, particularly with Treasury Secretary Janet Yellen pushing to pin all the blame for debt accumulation on self-identified rival states, such as China. In reality, it is the Biden government that is ignoring grim estimates from the nation’s own nonpartisan Congressional Budget Office. The US would need more than just "extraordinary measures" to avert default and set an example for the world.

History itself is a valuable guide in exposing the limits of Washington’s ‘success narrative’ on averting default. Look to 2011, when a debt ceiling showdown sent shockwaves through markets, effectively challenging the credibility of US leadership in regional markets at present.

Biden is too busy marketing a narrative of winning over Congress and bringing the US economy to stable shores, revealing the gaps in his own economic governance track-record, where colossal borrowing has been a key fixture. Painful consequences are now knocking at the gates.

The developing world needs a better example of debt sustainability than an American government that refuses to take its own advice on counterproductive borrowing. Rather than preparing the ground to protect ordinary Americans from the blowbacks of potential default, the Biden administration has ensured Congress remains gridlocked on the mother of all issues: avoiding default and catering to national interest.

For debt-stressed economies, the widely acknowledged Debt Service Suspension Initiative (DSSI) offers a wake-up call of its own. Washington has been increasingly reluctant to fully support any renewed payment suspension arrangement for dozens of countries. At present, it shows minimum resolve to use the DSSI mechanism to speed up the economic recovery of genuinely debt-stricken developing economies. All this is a damning indictment of America’s own commitment to fighting downward economic pressures and supporting the cause of free trade. After all, both are likely to be constrained if mounting debt splits regional growth, and keeps developing economies at the margins.

So unless the United States puts its “debt-ceiling” politics to rest, it will remain unqualified to speak to debt sustainability measures in the developing world.

Hannan Hussain

Hannan Hussain

5 Min Read

5 Min Read