Economic Crisis and Political Pressure: Will Pakistan Default?

Pakistan has one of the lowest tax-to-GDP ratios in the world, and important sectors of the economy, including agriculture and some military-run businesses, are excluded from paying income taxes.

-

Government officials claim that Pakistan decreased its imports by 35% to $5 billion in July, which will assist close the country's current account deficit

Pakistan is coping with numerous political and economic difficulties. As a result, Pakistan's rupee is one of the world's worst performing currencies, its foreign exchange reserves are pitifully small, and the nation has struggled to draw in much-needed foreign investment.

Currently, Pakistan is one of the few states with severe financial problems nowadays. The country fell into a crucial trap, which ultimately led to the country's deconstruction into a completely unstable state, owing to a wave of unheard-of and appalling policies developed by many governments over time. As a result, the country is more isolated globally, and the economy is worse than it was four years ago.

The new coalition government assured that they would successfully steer the country away from all the economic crises and horrible circumstances, but the reality is completely different. Pakistan has unquestionably reached its disappointing end in the short period of four months, and the economy is on the verge of defaulting.

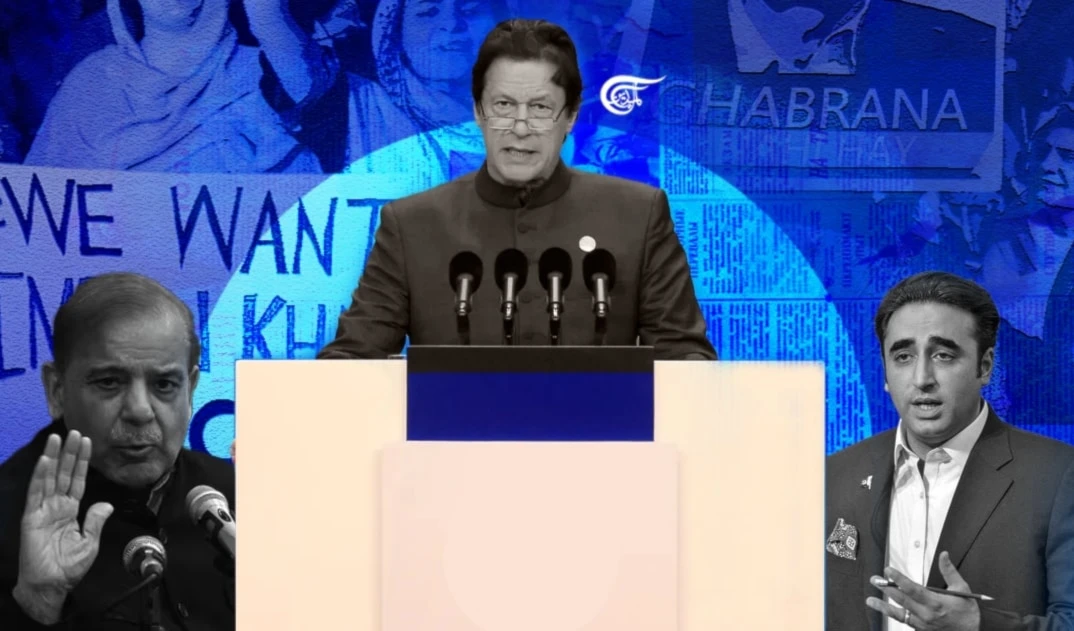

Previous Khan's government was toppled by the PDM alliance, a coalition of 11 political parties. The PDM accused him of bad leadership, heinous policies, mishandling foreign relations, growing inflation, and a precarious economic condition in Pakistan.

The current Prime Minister, Mr. Sharif, is the brother of Nawaz Sharif, a three-term prime minister and a former chief minister of Punjab. Although Shahbaz Sharif is a competent manager, he lacks the national-level political expertise necessary to oversee a diverse alliance.

Significantly, the current crisis in Pakistan is a result of decades of ineffective policies. The export of cotton textiles continues to be Pakistan's main source of income, and little has been spent on diversifying the economy. Moreover, the lowest in South Asia, at 52 %, the literacy rate creates an unskilled labour force that mostly migrates to the Gulf and sends remittances home.

Additionally, Pakistan has one of the lowest tax-to-GDP ratios in the world, and important sectors of the economy, including agriculture and some military-run businesses, are excluded from paying income taxes. In addition, governments have continued to provide subsidies rather than taxing citizens to prevent political and social upheaval.

The Covid-19 pandemic's effects and poor management by the previous governments severely damaged Pakistan's economy. It indicates that there is still no easy solution to Pakistan's economic problems, especially when the world economy is recovering from the simultaneous shocks of COVID-19 and the war in Ukraine. Increased utility and food expenses and possible interest rate increases will slow industrial activity.

However, Pakistan is in the situation in which we are currently standing due to the growing havoc of political instability within the state, an insurgency to maintain Pakistan's disastrous economy, survival with null remittances, ongoing targeting of the judiciary, and an abandoned battering government, but ambiguity within the state affairs led to debate the clarity of information being provided.

The country's issues are exacerbated by domestic political unrest and heightened susceptibility to terrorism in the wake of the Taliban takeover of its neighbour, Afghanistan. The nation is being made to feel hopeless about what might happen next and why Pakistan is facing such dire consequences or a situation. The current economic upheaval in Pakistan is also a result of factors like the Covid-19 pandemic, the rising cost of borrowing money globally, and the effects of the Russo-Ukrainian war.

Although the main players were assessing their operations in Pakistan, the government had recently authorized its proposal to sell off more spectrum in the upcoming weeks. As a result, significant players in Pakistan's telecom industry pointed to having to make difficult decisions, including reducing employee benefits and privileges in light of the challenging economic climate. The telecom sector was rendered unviable in Pakistan due to high taxes and contradictory policies. As a result, the telecom industry has already informed the government that Pakistan's revenue per subscriber had sharply decreased compared to other regional markets.

Notably, significant players in Pakistan's telecom industry pointed to making difficult decisions, including reducing employee benefits and privileges in light of the challenging economic climate.

There may be a serious risk of Pakistan's debt default if the IMF takes too long to release the next installment of its loan and friendly Gulf nations like the United Arab Emirates and Saudi Arabia take too long to assist.

Government officials claim that Pakistan decreased its imports by 35% to $5 billion in July, which will assist close the country's current account deficit. However, the increase in domestic energy costs by 50% to secure the IMF bailout will also lower energy demand and imports, which have put pressure on the currency.

Importantly, the government and several analysts believe that Pakistan's economic ship won't collapse, although certain financial professionals and economists are raising the alarm that default risks and the debt problem are not just theoretical concerns. Implementing difficult economic decisions like cutting subsidies and raising taxes is difficult due to the political climate. To overcome its current balance of payments issues and ensure longer-term economic stability, Pakistan urgently needs to get back on track with an IMF credit programme.

Ruqiya Anwar

Ruqiya Anwar

5 Min Read

5 Min Read