China lifts ban on exports of key 'dual-use items' to US

The ban suspension involves gallium, germanium, antimony, and super-hard materials.

-

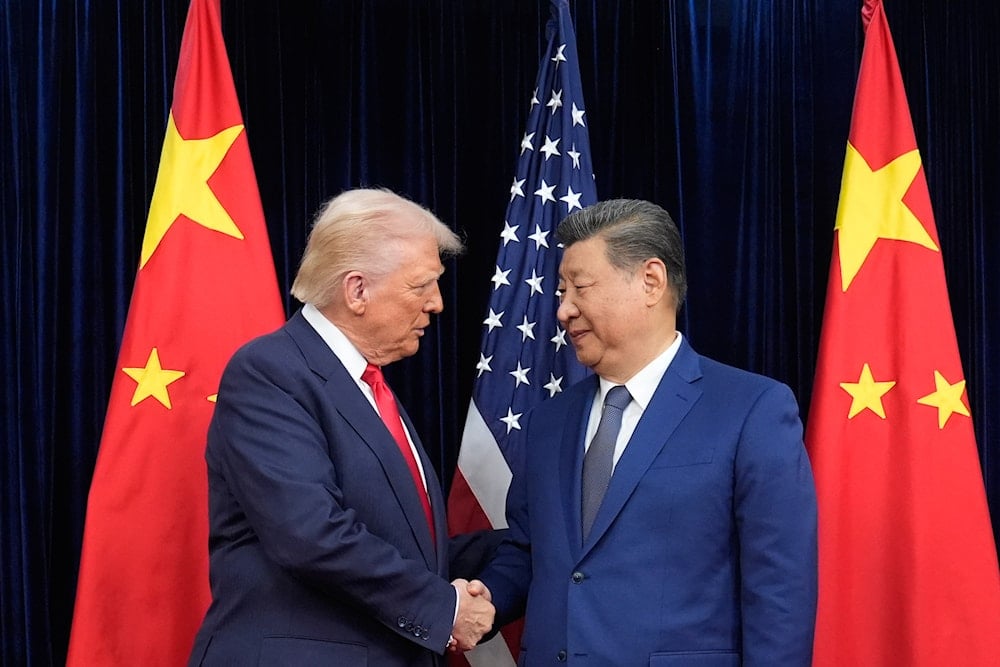

US President Donald Trump, left, and Chinese President Xi Jinping, right, shake hands before their meeting at Gimhae International Airport in Busan, South Korea, Thursday, Oct. 30, 2025 (AP)

China's Commerce Ministry announced on Sunday that it has suspended a ban, effective immediately from Sunday until November 27, 2026, on approving exports of "dual-use items" related to gallium, germanium, antimony, and super-hard materials to the United States.

The Ministry also suspended the stricter end-user and end-use purpose checks, which were announced alongside the ban, for exports of dual-use graphite to the United States.

On Friday, China suspended other export controls, including expanded curbs on certain rare earth materials and lithium battery materials, initially imposed on October 9.

Tensions between China and the United States continue to shape global trade dynamics, with recent developments extending far beyond tariffs into strategic competition over technology and critical minerals. The United States Trade Representative (USTR) has reopened an investigation into China’s compliance with the 2020 “Phase One” trade agreement, citing ongoing concerns over intellectual property rights and unmet purchasing commitments.

Trump, Xi strike temporary trade truce in Busan

In a notable diplomatic engagement, President Donald Trump met with Chinese President Xi Jinping on October 30, 2025, in Busan, South Korea. The summit resulted in a temporary easing of tensions, with Trump announcing a rollback of some tariffs and describing the meeting as a "truly great" step forward. Xi, in turn, pledged to pause certain export restrictions, particularly those impacting rare earth and battery-related materials crucial to US high-tech industries.

Despite the positive tone, structural issues remain unresolved. The US continues to enforce existing tariffs on many Chinese goods, while Beijing retains tight control over exports of strategic resources. Both sides appear to be using trade restrictions as tools in a broader geopolitical contest, especially over dominance in sectors like semiconductors, artificial intelligence, and clean energy.

The trade conflict has also accelerated shifts in global supply chains. American companies are increasingly pursuing “China +1” strategies, diversifying manufacturing through Southeast Asia to reduce reliance on Chinese production. Nevertheless, China maintains a strong foothold in upstream industries, particularly in materials and components essential for global manufacturing.

2 Min Read

2 Min Read