China to substantially increase debt issuance to boost economic growth

Chinese officials remain optimistic about reversing the economic slowdown and reaching a growth target of 5% for this year.

-

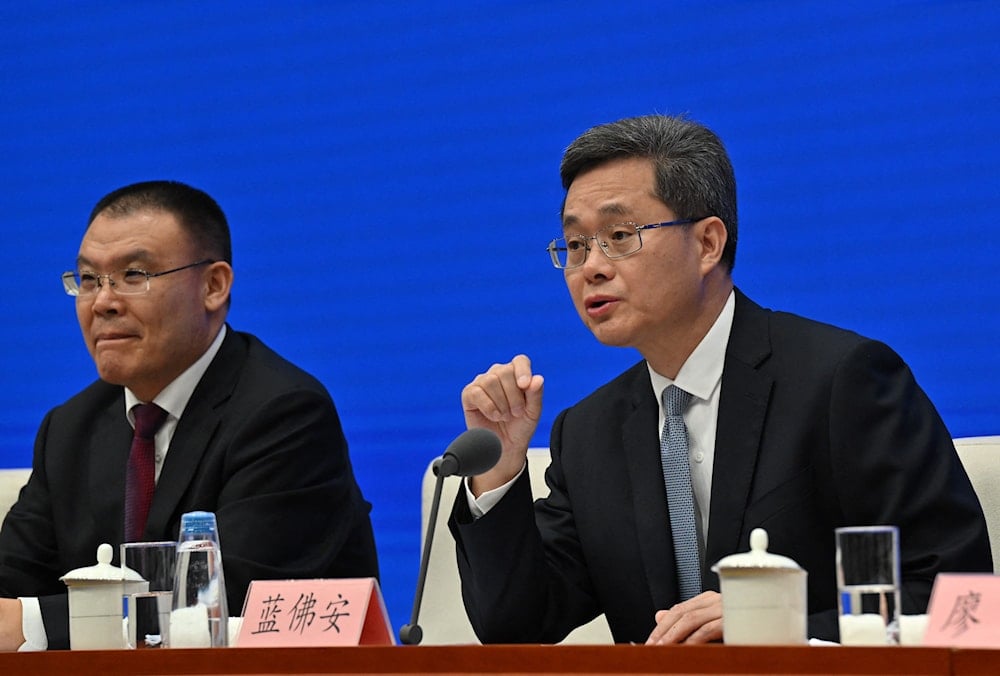

China’s Finance Minister Lan Fo’an (R) speaks next to Vice Minister of Finance Wang Dongwei (L) during a press conference in Beijing on October 12, 2024. (AFP)

China announced on Saturday plans to "significantly increase" government debt issuance to provide subsidies for low-income households, support the property market, and bolster the capital of state banks, as part of its efforts to revive economic growth.

China's economy has been adversely affected by a prolonged crisis in the property sector, coupled with persistently low levels of consumer spending.

While Finance Minister Lan Foan did not disclose the size of the upcoming fiscal stimulus—details closely watched by global investors to assess the sustainability of recent gains in Chinese stocks—he emphasized the introduction of more "counter-cyclical measures" during a press conference.

"There is still relatively big room for China to issue debt and increase the fiscal deficit,” Lan pointed out.

He said Beijing was "accelerating the use of additional treasury bonds, and ultra-long-term special treasury bonds are also being issued for use."

"In the next three months, a total of 2.3 trillion yuan of special bond funds can be arranged for use in various places," the Chinese Minister confirmed.

Local governments to have higher debt ceilings

Beijing also plans to "issue special government bonds to support large state-owned commercial banks," he added.

The debt ceiling for local governments will also be increased to enable higher infrastructure spending and job protection.

The announcement builds on a series of measures introduced in recent weeks, including interest rate cuts and enhanced liquidity provisions for banks.

The measures would "help ease liquidity and debt pressures on local governments and real estate companies," Vice Finance Minister Liao Min indicated.

Recent economic data has repeatedly fallen short of expectations, fueling concerns among economists and investors that the government's growth target of approximately 5% for 2024 is at risk, with a potential longer-term structural slowdown looming.

As further economic data from September is set to be released in the coming week, signs of continued weakness are anticipated. Nevertheless, Chinese officials remain confident that the 2024 growth target will be met.

Speculation around China's fiscal stimulus has been intense since the Politburo meeting in September, where top Communist Party leaders expressed growing urgency about the country's economic challenges.

Chinese stocks surged by 25% to two-year highs following the meeting, but subsequently retreated as investors grew anxious over the lack of specifics regarding the government's spending plans.

China's increased debt issuance will require approval from its parliament, which is expected to convene in the coming weeks.

While policymakers have implemented a range of stimulus measures, including rate cuts and relaxed housing purchasing regulations, economists argue that further actions are necessary to effectively lift the economy from its current slump.

On the same day, China’s leading banks announced a reduction in interest rates on existing mortgages, effective October 25, following a government directive.

China Central Bank to lower mortgage rates

Last month, the People's Bank of China instructed commercial banks to lower mortgage rates by October 31. Additionally, it reduced interest on one-year loans to financial institutions, lowered reserve requirements for lenders, and facilitated lower rates on existing mortgages. This week, the central bank further enhanced market support by injecting tens of billions of dollars in liquidity for firms to purchase stocks.

In late September, the central bank introduced its most strict monetary support measures since the COVID-19 pandemic, including interest rate cuts, a 1 trillion yuan liquidity injection, and steps to support both the property and stock markets.

While these measures have boosted market sentiment, analysts emphasize the need for Beijing to address more deep-seated structural issues, such as stimulating consumption and reducing reliance on debt-driven infrastructure investment.

The International Monetary Fund estimates that China's central government debt stands at 24% of GDP, while overall public debt, including that of local governments, is estimated at $16 trillion, or 116% of GDP.

Read more: China 'seriously concerned' over US trade restrictions

4 Min Read

4 Min Read