Gold price hits all time high; USD, Treasury bonds' yields diminish

Investors say that the weakening US dollar and the decline of US Treasury yields are pushing Gold prices up to historic levels.

-

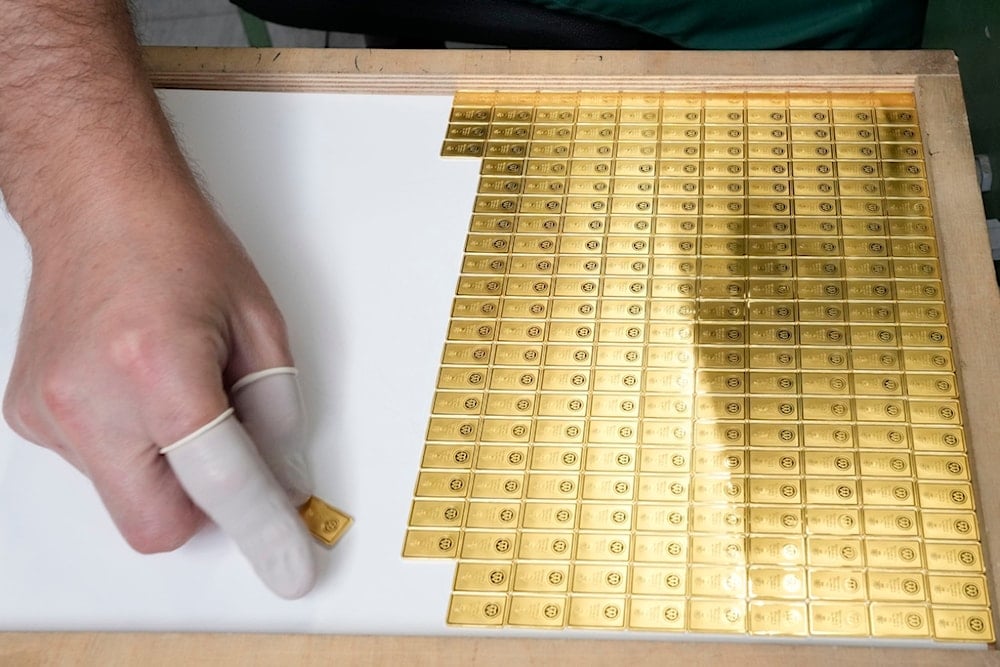

Investment gold bars are being arranged for storage at the Mint of Poland, in Warsaw, Poland, on June 25, 2024 (AP)

The price of gold hit a record peak on Tuesday, reaching $2,463.80 per ounce in late afternoon London transactions.

Fueled by trader expectations of falling US interest rates in September, gold prices exceeded the previous high of $2,450.07, which was recorded in May.

Ricardo Evangelista of ActivTrades said that gold is benefiting from the weakening US dollar and the decline of US Treasury yields, which rival gold on the global market.

Data published last week confirmed that inflation in the United States was returning to levels close to those the Federal Bank intended.

Fawad Razaqzada, an analyst at City Index, said that there is no doubt that the recent surge in gold prices could be partially attributed to the declining dollar and falling bond yields. He said that an unexpected drop to 3% in US consumer inflation last week also spurred gold's increased trading price.

Read more: BRICS' push to reduce US dollar dominance with digital currencies

Gold becomes more attractive to investors, as USD faces turbulence

Gold has historically served as a reliable means of long-term value retention and has become increasingly attractive to investors seeking to diversify their portfolios.

The US dollar, on the other hand, is facing multiple crises, spurred by the Global South's attempt to replace its use in bilateral trade, the Fed's money supply policies, and global conflict.

The increase in the price of gold holds significance due to its nature as a dollar-denominated asset. When the value of gold rises, it often indicates a decrease in the value of the dollar.

An increase in the price of gold can reflect various factors, including a loss of confidence in the dollar. When investors perceive higher risks or uncertainties associated with the dollar, they may seek refuge in gold as a safe-haven asset, thus driving its price up.

Read more: Fed keeping close eye over gold prices: Fed official

2 Min Read

2 Min Read