Powell admits Fed’s rate hike 'mistake', vows to be cautious on cuts

With the CPI now hovering around 3% per year, the Fed is under scrutiny for when it will decide to cut interest rates.

-

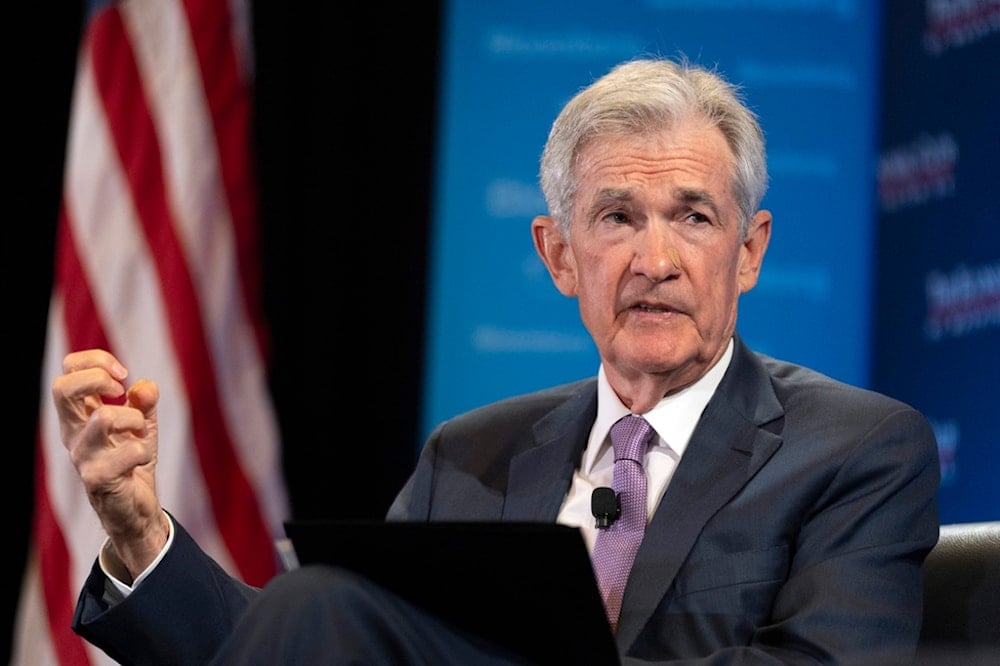

Federal Reserve Chair Jerome Powell participates in a conversation with the Economic Club of Washington, DC, Monday, July 15, 2024, in Washington (AP Photo/Manuel Balce Ceneta)

Federal Reserve Chairman Jerome Powell on Monday acknowledged that the central bank erred by delaying interest rate hikes until inflation became a major issue, and he promises not to make the same mistake with future rate cuts.

At an event with the Washington Economic Club, Powell admitted, "We essentially overestimated how quickly the economy would return to normal."

He explained that the Fed initially viewed the post-pandemic price increases as "transitory" and believed that inflation would subside on its own without the need for immediate rate adjustments.

"You don't want to intervene with interest rates if something is going to go away quickly," he said. "You look through things like a temporary oil [price] shock, so that was the mistake — it [the inflation] actually didn't reverse itself."

When the Fed began to hike rates, it did so with little restraint, raising them 11 times between March 2022 and July 2023 to clamp down on prices.

Read more: Fed keeping close eye over gold prices: Fed official

For over a decade before the COVID-19 outbreak in March 2020, price growth remained below the Fed’s long-standing 2% annual target. However, the pandemic-induced temporary shutdown of the US economy, coupled with supply chain disruptions and trillions of dollars in government relief spending, drove inflation—measured by the Consumer Price Index (CPI)—to a four-decade high of 9.1% by June 2022.

With the CPI now hovering around 3% per year, the Fed is under scrutiny for when it will decide to cut interest rates.

While Powell refrained from saying when he might consider rate cuts, he did explain to the Washington Economic Club that inflation has "long and variable lags" and why the Fed should avoid waiting too long to ease monetary policy.

"The implication of that is that if you wait until inflation gets all the way down to 2%, you’ve probably waited too long, because the tightening that you’re doing, or the level of tightness that you have, is still having effects which will probably drive inflation below 2%," Powell said.

He also noted that the Fed seeks "greater confidence" that inflation is sustainably moving toward its 2% target.

"What increases that confidence in that is more good inflation data, and lately here we have been getting some of that," Powell added.

Federal Reserve Chair Jerome Powell said second-quarter economic data has provided policymakers greater confidence that inflation is heading down to the central bank’s 2% goal, possibly paving the way for near-term interest-rate cuts https://t.co/TnstgcSYyX pic.twitter.com/QMAUqjC6vp

— Bloomberg TV (@BloombergTV) July 15, 2024

The Fed’s Federal Open Market Committee is scheduled to meet on July 30-31 to decide on interest rates, but money market traders are primarily anticipating that any easing will occur at the central bank’s September 17-18 meeting.

Read more: Delinquency rates on loans in US highest in 5 years, sparks concerns

3 Min Read

3 Min Read