Indian companies have been dodging the US dollar in trade

Yuan, euros, dirhams, and the Hong Kong dollar are some of the currencies used in trade in India.

-

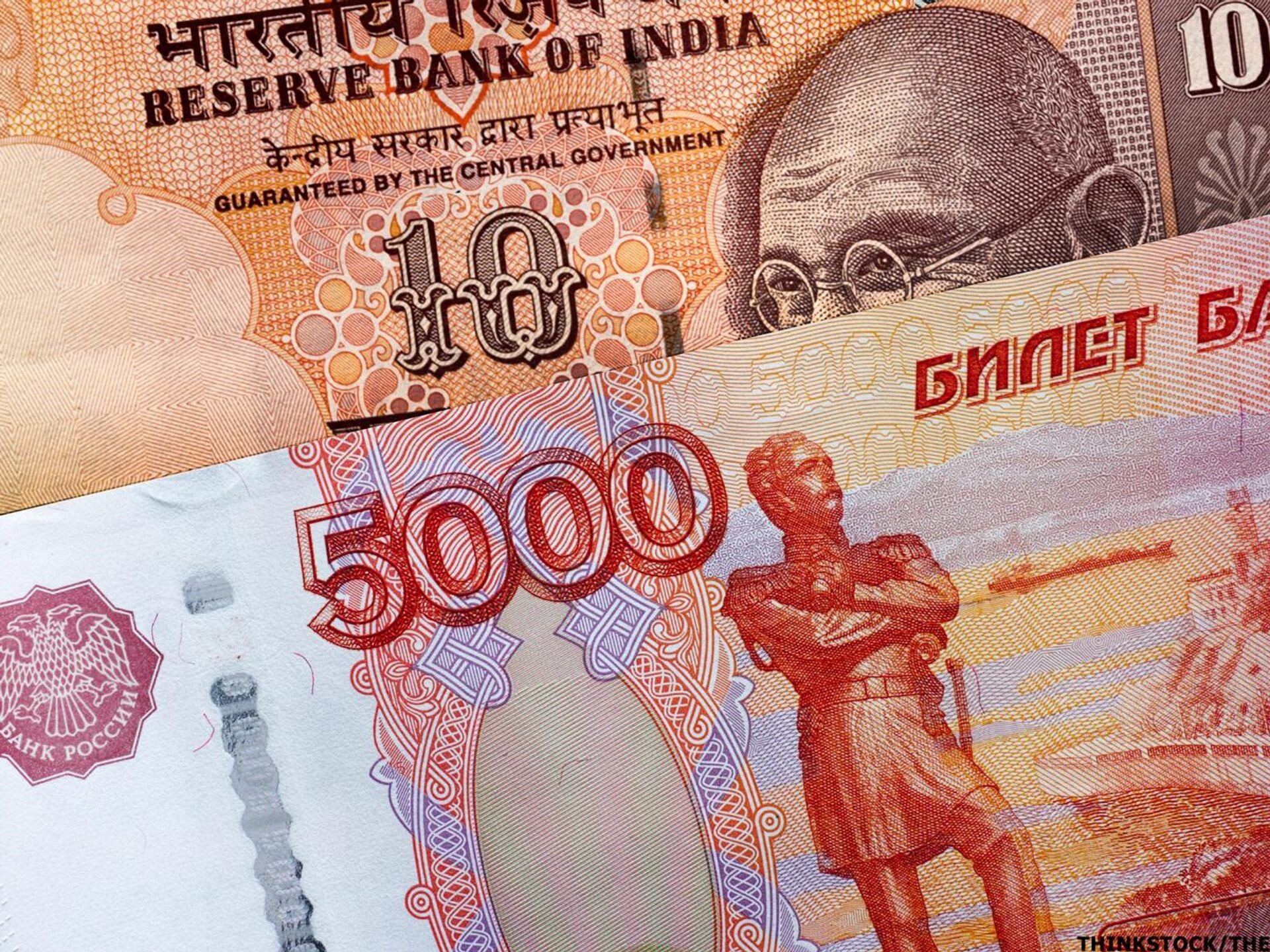

Indian rupees and Russian rubles are isolating the dollar as the West attempts to isolate Moscow.

Indian companies have been slowly abandoning the US dollar, using Asian currencies more and more to pay for Russian coal imports, according to customs documents and industry resources. This further enables them to cut the risks of breaching West-led sanctions against Russia.

Read more: US dollar may lose dominance due to Russian sanctions: IMF

Though Reuters has reported on a large Indian coal deal involving China's currency, the yuan, with customs data emphasizing how non-dollar settlements are becoming commonplace.

India has drastically increased Russian oil and coal purchase since February 24. This has helped Russia push back against sanctions, enabling India to secure raw materials at competitive prices compared to other countries' raw materials.

In July, Russia became India's third-largest coal supplier. Russian energy imports to India increased by more than 20% compared to June, reaching 2.06 million tonnes - a record.

In June, India purchased minimally 742,000 tonnes of Russian coal using non-dollar currencies, which marks 44% of the 1.7 million tonnes of Russian imports that month, according to Reuters. Some of the currencies used by Indian steelmakers and cement manufacturers are the UAE dirhams, Hong Kong dollars, yuan, and euro in recent weeks.

The Chinese yuan accounted for 31% of the non-US dollar payments for Russian coal in June, while the Hong Kong dollar accounts for 28%. The euro, furthermore, accounts for just below a quarter and the Emirati dirham around a sixth, according to data from the trade source to Reuters.

Furthermore, the Reserve Bank of India approved payments for commodities in its currency, the rupee, which will essentially boost bilateral trade with Russia using its currency.

Traders note that the US dollar has been dominant in the Indian commodity export trade. However, for deals in a currency other than the US dollar, lenders may have to send dollars to bank branches in the country of the original currency, or banks that are connected to the branches, to exchange for the aforementioned currency for trade settlement.

Read next: Putin urges the BRICS to face exceptional sanctions imposed by West

2 Min Read

2 Min Read