Xi: China eyes dropping dollar in oil trade, purchases up by 12%

The vast bulk of worldwide oil sales—roughly 80%—are conducted in dollars, but moving to yuan would boost the currency's value highly.

-

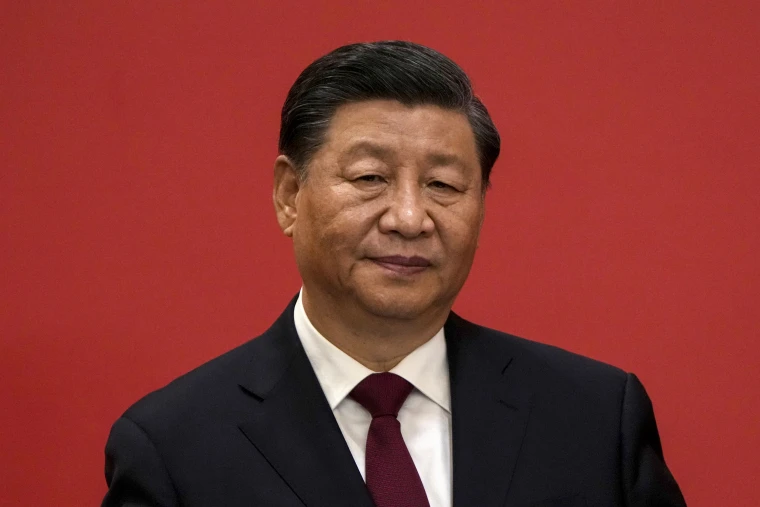

Chinese President Xi Jinping (NBC News)

As cited by Reuters, Chinese President Xi Jinping assured Gulf Arab leaders during a Chinese-Arab summit hosted by Saudi Arabia this week that his country would put in the effort to purchase energy in yuan rather than dollars.

Oil purchases were boosted by China, the globe's biggest crude importer, in November by 12% year-on-year. However, Chinese state refiners increased purchases of US crude oil while simultaneously keeping high imports of Russian oil - before the December 5 price cap imposed by the EU.

The price cap measure insinuates that oil sold at $60 per barrel or less can continue to be delivered. For oil above that price, companies based in the countries involved in the cap will be prohibited from providing services of maritime transport like insurance.

On the other hand, China’s independent refiners recorded a high amount of heavily discounted Iranian crude oil from Malaysia - commonly used as a transfer point for oil originating from Venezuela and Iran, both hit with illegal sanctions by the US.

Saudi Arabia constituted 18% of China’s total crude oil purchases, making it the Asian country's top oil supplier, in the first 10 months of this year according to Chinese customs data - amounting to 73.54 million tons, or 1.77 million barrels per day.

De-dollarize the world's economies

China purchases more than a quarter of Saudi Arabia's oil exports. Those sales, if priced in yuan, would raise the value of China's currency. The Saudis were considering back in March including yuan-denominated futures contracts, known as the petro-yuan, in the pricing model of Saudi Arabian Oil Co., known as Aramco.

It would be a significant move for Saudi Arabia to price even a portion of its nearly 6.2 million barrels of petroleum exports in a currency other than dollars. The vast bulk of worldwide oil sales—roughly 80%—are conducted in dollars, and the Saudis have done so solely since 1974 when they struck a deal with the Nixon administration that provided security assurances for the country.

Interest in using the yuan and other currencies from oil importers has witnessed a hike following the persistent and unending sanctions by the US and the West against Russia, one of the world’s biggest oil producers and exporters, in light of the war in Ukraine.

Back in October, a report released by the Bank of International Settlements (BIS) showed that the Chinese yuan has moved up to the fifth-most traded position, in terms of total global foreign exchange turnover, with a market share of 7%.

The yuan's new ranking, which increased from eighth place in a 2019 survey, highlights the currency's appeal in the face of efforts to de-dollarize the world's economies and a general consensus among investors about the world's second-largest economy's promising future.

In more recent events, Russia embracing the Chinese yuan has had an effect on several Chinese entrepreneurs, as Russian businesses might now negotiate contracts in yuan rather than the dollar or euro. This is, according to Chinese entrepreneur Wang Min, an exciting "win-win" situation for Chinese and Russian businesses.

The businessman said, "We hope that next year sales in Russia can account for 10-15% of our total sales." According to Reuters, Wang intended to profit from Russia's speedily "yuanized" economy, as the sanctioned nation looks toward an Asian market for financial stability. He envisions a win-win situation where Chinese exporters lower their currency risks and Russian purchasers have easier access to payment.

4 Min Read

4 Min Read