A true American horror story: The debt deal and the future of the US

With the freshly struck debt deal potentially passing the US Senate to be ratified, Americans remain treading on thin ice because being in dire straits spells trouble not only for the government and the average American but for the world – indicating another global pandemic-scenario crisis.

-

A true American horror story: the debt deal and the future of the US

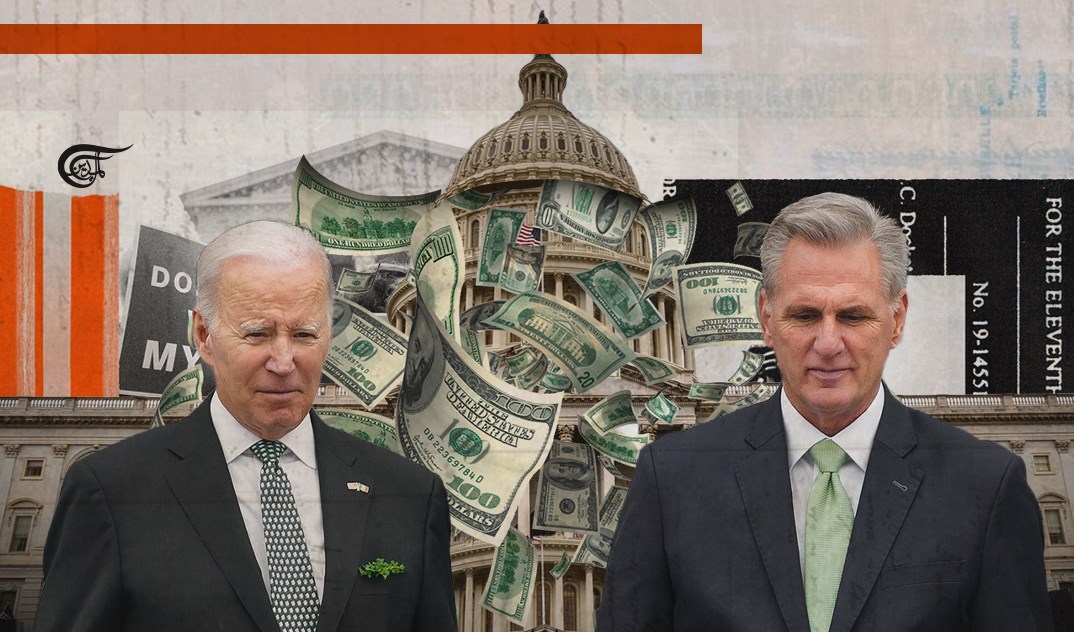

The US has been in quite a pickle with a Republican vs. Democrat strife over the debt ceiling bill, between House Speaker Kevin McCarthy, who wants to cut government spending, and President Joe Biden who wants to increase it.

The what, how, and when will be detailed here to better know what the American people are up against before the deadline. This is your explainer to keep it short and sweet – as ironically possible because money doesn't grow on trees, but apparently, it does in the new debt deal.

What does defaulting on a debt mean?

When one does not fulfill the obligation of paying off a loan or debt on time, it’s called a default, but when the limit is being raised to spend more than one is able to afford, we call that the US government.

The first debt ceiling was approved back in 1917 to allow then-President Woodrow Wilson to fund the needed material for World War I. However, the US has never in its history defaulted on debt, despite the fact that it has raised the debt ceiling 78 times since 1960 – 49 of them were implemented under Republican presidents, and 29 under Democratic presidents.

The current national debt stands at $31.4 trillion, which capped the debt ceiling. One might ask though, what bills could the US possibly have to pay to have reached a whopping $31.4 trillion?

The government receives money from revenue mostly collected in taxes, public services, and the sale of natural resources, leases, and customs duties. This revenue is spent to fund government employee wages, Medicaid and Medicare, social security, financial aid, and education programs, and retirement funds.

In a report by The Hill on Tuesday, an average US household now carries $10,000 in credit card debt, raising the US credit card balance to $1 trillion, which adds to that debt.

The problem is that the US is breaking its own bank by spending more than it has or takes. In fiscal year 2023, it collected $2.69 trillion in revenue from corporate and individual taxes and national public services like parks. In fiscal year 2023, it spent $3.61 trillion, creating a deficit of $925 billion, according to the Treasury’s data.

This is due to military and defense spending, exacerbated by the war in Ukraine. As the US continues to recklessly supply and voluntarily gift the Ukrainian forces military aid and weapons, the Republicans are still not happy campers as their stance remains against providing 'blank checks' to Ukraine.

According to data from the Council of Foreign Relations, the US so far has provided Ukraine with a total of $76.8 billion between January 24, 2022, and February 24, 2023. The most recent package was announced on May 31 for $300 million – ‘the 39th drawdown of equipment’ per White House National Security Council Spokesperson John Kirby.

What’s the damage?

A draft deal was passed by the House on Thursday but it is yet to pass the Senate and Congress.

The draft includes raising the debt ceiling until January 2025, limiting non-defense spending that will increase by 1% in the fiscal year 2025, adding more work requirements for some food stamp recipients, and taking back some unused Covid-19 relief funds which amount to approximately $30 billion.

Under the new provisions, the maximum age limit for adults participating in the Supplemental Nutrition Assistance Program (SNAP) will be gradually raised to 54 by 2025. However, it's important to note that this particular provision is set to expire by 2030, thereby reverting the maximum age back to 49.

If Congress doesn’t pass it by Treasury Secretary Janet Yellen’s deadline of June 5, being in hot water would be an understatement for the hegemonic power.

Being in dire straits spells trouble not only for the government and the average American but for the world – indicating another global pandemic-scenario crisis.

First and foremost, Americans will see an even higher increase in the inflation they are experiencing. Government employees won’t be paid for their work, food prices will skyrocket and 401K retirement plans will stop due to insufficient funds, as will essential programs such as social security, Medicaid, infrastructure, and financial aid.

On the financial side, the US as an economic power will lose credibility, stock market prices will go down as they did during the Obama administration which threatened a stock market crash it has not experienced since the 2008 financial crisis.

Moody's Analytics states that a default would lead to a loss of almost seven million jobs in the US, and that does not count the loss of employment it would cause on a global scale as a result of a potential global crisis.

Consumer confidence in the financial market would be dealt a huge blow, as higher interest rates could move money away from developing infrastructure and healthcare, borrowing costs for homeowners increase and consumer prices go up.

Yet, raising the debt ceiling increase borrowing by the Treasury and leave financial institutions, which are already in a fragile state after the record crash of three major banks in March, suffering from more drain in deposits and a declined cash volume.

How could this affect anyone in the nearest country or on the other side of the world?

Investors around the world would be forced to sell American treasury bonds, which would heavily weaken the dollar, keeping in mind that over half of the world’s foreign currency reserves are held in dollars.

What’s in store next?

Senior GOP Congress members are now calling for the unseating of McCarthy over the debt ceiling agreement he reached with Biden, according to Politico, which added that Rep. Chip Roy (R-TX) said conservative leaders will face a “reckoning" if the bill was passed.

Roy saw the deal as a “betrayal of the power-sharing arrangement that we put in place” among the House GOP, adding that “Not one Republican” should vote in favor of the deal, while Republican Governor and current presidential candidate Ron DeSantis called the agreement 'inadequate'.

Reaching a draft deal that has been partially agreed upon does not mean the American economy is out of the woods because if Congress rejects the bill, the nation could very well be lost in the woods and find it hard to get out.

America already has a growing list of problems, and this may just be the cherry on top that could make this very fragile cake crumble.

6 Min Read

6 Min Read