EU eyes digital Euro to secure payment autonomy: FT

European Central Bank chief economist Philip Lane recently stated, "It is imperative for the ECB to introduce a digital euro".

-

Italian Euro coins are pictured for illustration on Monday, Dec. 10, 2018 in Gelsenkirchen, Germany (AP)

The Financial Times on Sunday, in a column by Martin Sandbu, highlighted growing urgency among European policymakers to push forward with the development of a digital euro, as geopolitical competition over global payments intensifies.

European Central Bank chief economist Philip Lane recently stated, "It is imperative for the ECB to introduce a digital euro". A few weeks earlier, Eurogroup president Paschal Donohoe spoke of a "heightened level of urgency" in advancing digital currency plans.

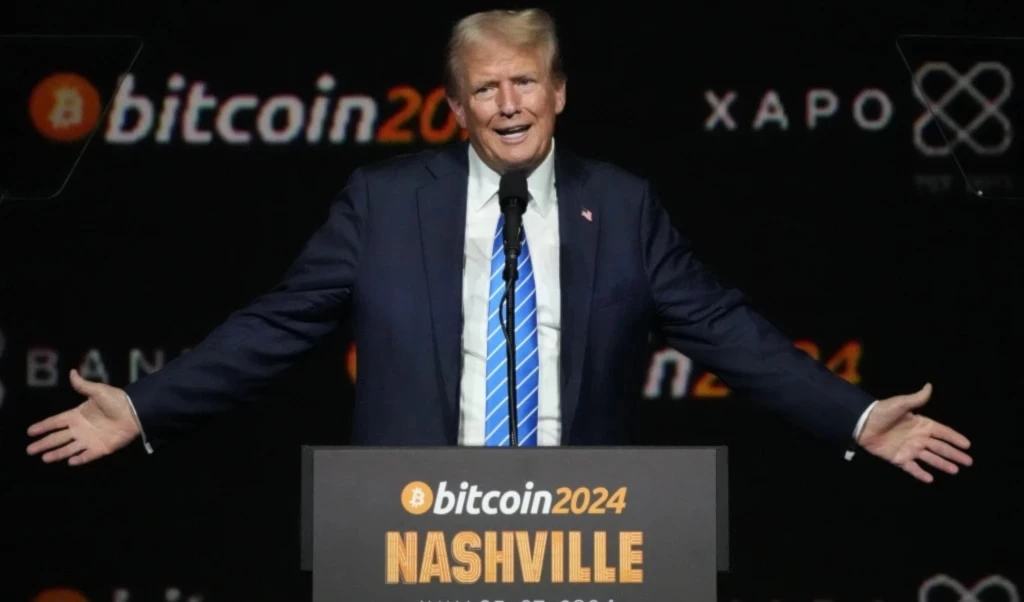

These remarks, Sandbu argues, signal that while much of Europe remains preoccupied with US tariffs under Donald Trump, some leaders are looking ahead to a deeper economic battle: the United States' efforts to consolidate its dominance over international payment systems.

Among Trump's many executive orders is one promoting the international use of dollar-denominated stablecoins—privately issued digital currencies. Given the administration's makeup, including tech-linked figures like Elon Musk (PayPal co-founder) and Howard Lutnick (linked to Tether), there's strong reason to believe these efforts will be forcefully pursued. Though these individuals may stand apart from the traditional political class, they share an interest in maintaining US control over global payments.

Payment Geopolitics

The financial landscape itself is shifting. The use of the US dollar as a geopolitical tool—especially via mechanisms like SWIFT, which has been used to isolate adversaries—has accelerated the search for alternatives. From BRICS currency proposals to blockchain-based stablecoins, new technologies are offering faster, cheaper alternatives to traditional systems.

Within this context, the digital euro is emerging as a strategic necessity. Properly designed and implemented, it could serve as a state-backed counterweight to dollar-based stablecoins, ensuring that Europe retains autonomy over its monetary affairs.

Read more: Digital payment tools to reduce reliance on USD, Euro: Russian Deputy

The issue is not theoretical. As Sandbu recalls, when Facebook introduced its proposed digital currency Libra in 2019, alarm bells rang in Brussels. And when Trump sanctioned Iran, Europe struggled to conduct basic trade due to its dependence on US-linked banking systems.

Today, the eurozone's payment infrastructure remains surprisingly exposed. ECB figures show that two-thirds of card payments in the euro area are processed by non-European companies. In 13 of the 20 euro-using countries, no national card network exists. As one central banker put it, "When you go to buy milk, it's either [physical] cash or Visa/Mastercard."

Digital Sovereignty

The danger is that if US dollar stablecoins become widespread, Europe could face "digital dollarisation"—a shift where businesses and consumers transact and store value in tokens outside the ECB's control, weakening its ability to manage monetary policy.

Some continue to question the need for a digital euro, but their numbers are shrinking. While the project remains defensive in nature for now, Sandbu argues it's time to also make the positive case. Replacing fee-based foreign providers with a domestic, low-cost digital alternative would boost economic efficiency within the eurozone.

Read more: Bitcoin falls over 5% to $81K after US tariff announcement

Moreover, the ECB is already exploring how a digital euro could interface with non-euro currencies, positioning it to compete globally. However, current plans cap wallet holdings at relatively low levels to avoid bank disintermediation—insufficient for large-scale cross-border business transactions.

3 Min Read

3 Min Read