Japan joins the US in its chip war with China

Following similar moves by the US and the Netherlands, Japan's government announces a plan to put restrictions on computer chip-making exports.

-

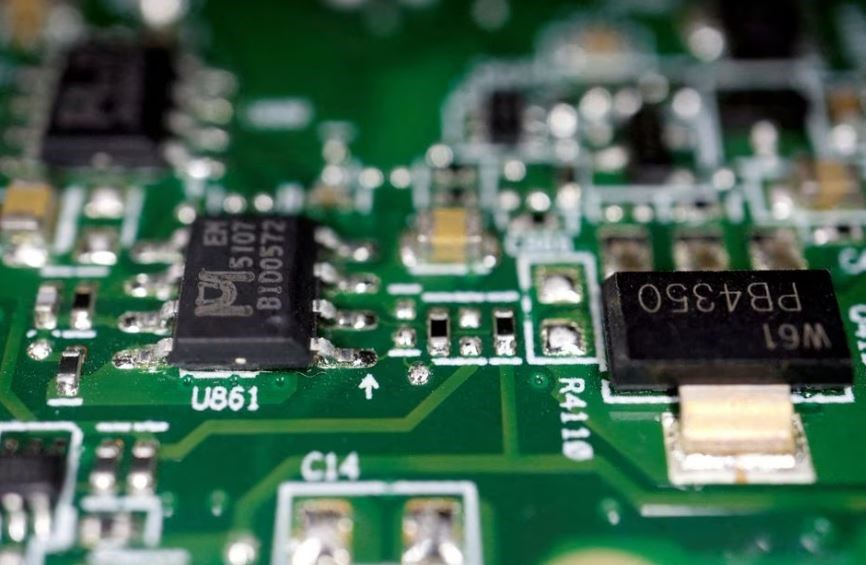

Semiconductor chips are seen on a printed circuit board in this illustration picture taken on February 17, 2023. (Reuters)

Japan's government announced measures to limit exports of 23 different types of semiconductor manufacturing equipment on Friday, following pressure from Washington to limit Beijing's access to semiconductor manufacturing technology.

The decision was made as Tokyo revealed its top diplomat would travel to Beijing this weekend, the first time in more than three years.

China and Japan are important trading partners as the second and third-largest economies in the world, respectively. Nevertheless, relations between the two countries have deteriorated recently due to US-Japan's new militarism.

It is worth noting that the Netherlands adopted such export limits earlier this month, citing national security concerns. Amid the global struggle between powers, mainly China and the US, to gain tech superiority and establish world dominance in the industry, the European country has been the center of the US attention as it is home to one of the most advanced firms in the tech industry worldwide.

Western officials, particularly in Washington, have constantly pressured their allies to ban companies from exporting chips to China, the equipment needed to manufacture them, as well as any sort of semiconductor expertise.

Moreover, the Netherlands did not cite China in announcing its restrictions.

Japan also refrained from characterizing the regulations as being directed at China, with trade minister Yasutoshi Nishimura claiming that their goal was to "prevent the military diversion of technologies".

Japan "intends to play a responsible role in the international community" as a country with advanced memory-chip technology, he added.

Meanwhile, Washington has been crystal clear that it wants its allies to join it in limiting Chinese access to the technology.

About 10 major companies, including Tokyo Electron and Nikon will be impacted by the new measures, Jiji Press reported, quoting unnamed government sources.

Here's what you need to know!

The United States imposed sanctions in October aimed at undermining China's flourishing semiconductors industry.

This was one of the Biden administration's most escalating steps against China in quite a while, marking a pivotal step aimed at hampering the modernization of the Chinese armed forces.

Semiconductors, more commonly known as chips, are a highly pivotal component in the defense industry, especially as it shifts and takes a more modern approach that delves into the futuristic realms requiring advanced semiconductors, which are crucial in manufacturing many things, from computers to autonomous vehicles, and even hypersonic weapons.

The Biden administration knew what it was doing with this step that intends to jeopardize China's advancement and push it back years into the past at a level not adequate with that of this time.

Though the restrictions will be of great cost for China in the meantime, the economic giant will surely not be set back for too long, especially since chips are key for national defense. China has already begun pouring national resources into the pivotal industry as an investment in the protection of its sovereignty and standing as a global superpower.

China's national approach is likely to assign thousands of engineers and computer scientists to design and manufacture semiconductors.

A RAND Corporation report issued in February highlighted how China's current defense systems use less sophisticated chips made in China, meaning the US sanctions will not affect Beijing's military capabilities, and the damage will be limited. And though costly for China and will cause strain on its resources, the PRC is fully capable of producing its cutting-edge chips. However, production is projected to be just enough to fulfill its needs instead of being for market consumption.

If anything, US chip firms will bear the brunt of their own country's decisions, especially as China serves as their largest market, accounting for 33%, 31%, and 27% of Applied Materials, Lam Research, and Intel, respectively.

Nvidia and Applied Materials will sustain heavy losses due to the sanctions, projecting a loss of $400 million next quarter, which will bring down revenue by 7% for the former and 6% for the latter.

The decision's time is far from fitting, as a staggering US economy took its toll on the semiconductor industry already experiencing a decline in revenue and an increase in input costs.

Read next: China hits back against US chip sanctions, files WTO complaint

4 Min Read

4 Min Read