Over 16 years, JPMorgan allegedly processed over $1bln for Epstein

The US Virgin Islands lawyer has accused JPMorgan of ignoring Epstein's sex trafficking operation after processing $1 billion on his behalf.

-

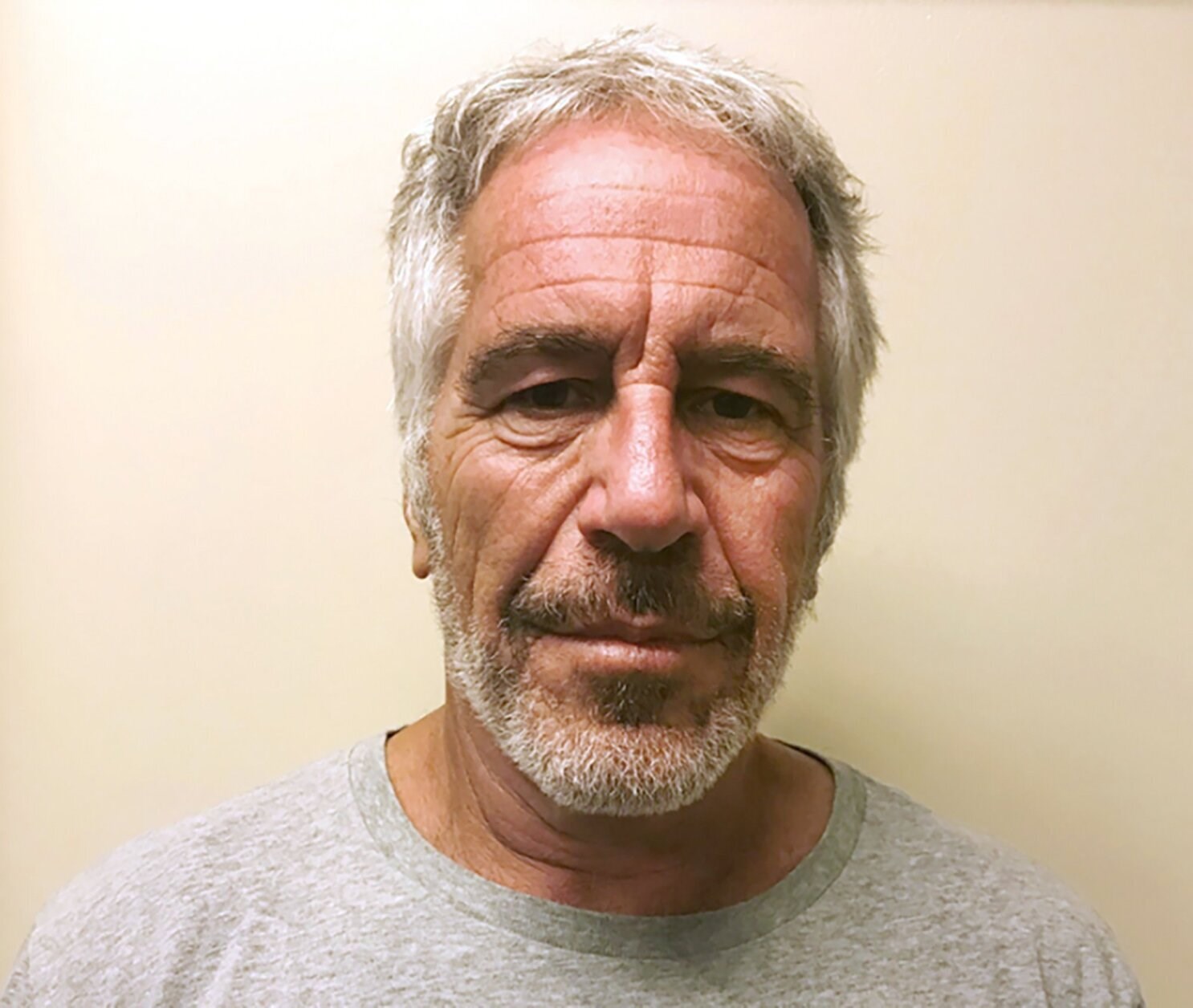

Jeffery Epstein's mugshot provided by the New York State Sex Offender Registry, March 28, 2017 (AP)

JPMorgan Chase has admitted to processing more than $1 billion in transactions for the late financier Jeffrey Epstein over a period of 16 years.

The information was made public by a lawyer representing the US Virgin Islands during a hearing related to its ongoing lawsuit against the banking giant.

Mimi Liu, the attorney representing the US Virgin Islands, where Epstein owned two islands, said during the hearing that JPMorgan had reported these transactions as suspicious to the US Treasury Department shortly after Epstein's suicide in 2019. However, the details of these reports remain confidential, as they are not publicly available.

Jeffrey Epstein, a former client of JPMorgan from 1998 to 2013, was fired by the bank amid mounting controversies surrounding his involvement in sex trafficking. At the time of his death, he was awaiting trial on charges related to these activities.

The US Virgin Islands filed a lawsuit against JPMorgan, seeking at least $190 million and potentially more in damages. The territory alleges that the bank turned a blind eye to numerous red flags indicating that Epstein was running a sex trafficking operation, primarily due to his status as a highly profitable client.

JPMorgan vehemently denies any prior knowledge of Epstein's illicit activities and has criticized the US Virgin Islands for its close association with the financier.

Liu's revelation of the previously undisclosed $1 billion in transactions was presented as part of her argument that US District Judge Jed Rakoff should consider whether JPMorgan was complicit in Epstein's sex trafficking prior to the trial. Liu contended that it would be implausible for a reasonable juror to believe that JPMorgan was unaware of Epstein's activities, asserting that the bank provided comprehensive banking services to Epstein's sex trafficking operation.

"JPMorgan was a full-service bank for Jeffrey Epstein’s sex trafficking," Liu said.

In response, Felicia Ellsworth, an attorney representing JPMorgan, argued against Judge Rakoff pre-determining the bank's knowledge before going to trial, adding that current and former employees have stated that they were unaware of Epstein's heinous activities. Ellsworth also pointed out that JPMorgan had notified the Treasury Department about Epstein's transactions on multiple occasions, dating back to 2002.

Furthermore, Ellsworth contested the US Virgin Islands' accusation that JPMorgan obstructed investigations into Epstein's activities. She stated that the bank had actively inquired with federal authorities about their own investigations into Epstein's conduct, characterizing these actions as the opposite of obstruction.

A trial for this case is scheduled to commence on October 23, 2023. Judge Rakoff has indicated that he will make a decision by the end of September to resolve significant legal disputes before the trial proceeds.

It's worth noting that in June, Judge Rakoff preliminarily approved JPMorgan's $290 million settlement with women who alleged they were victims of Epstein's abuse. Additionally, Deutsche Bank, where Epstein was a client from 2013 to 2018, previously reached a $75 million settlement with his accusers.

Read more: Negligence, misconduct behind Epstein's death, DOJ claims

3 Min Read

3 Min Read