UK wealth managers report influx of funds from American investors: FT

UK wealth managers have reported a notable rise in inquiries from US investors seeking to move their assets to the UK, driven by concerns over the actions of Donald Trump and his administration.

-

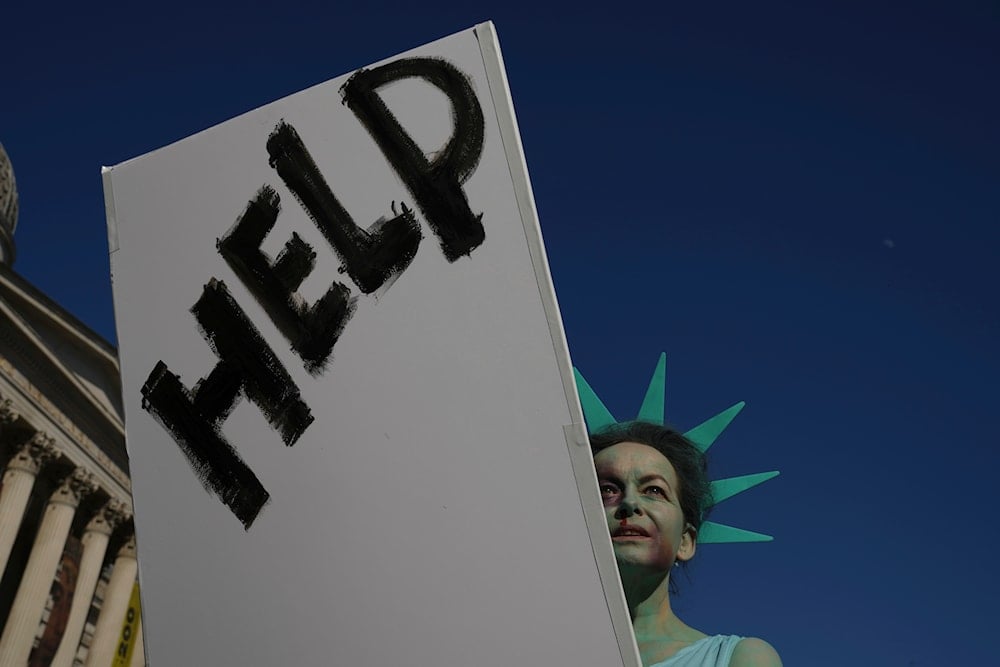

Helena Jensen joins a "Hands Off!" demonstration against US President Donald Trump and Elon Musk, at Trafalgar Square, in London, Saturday, April 5, 2025 (AP)

Helena Jensen joins a "Hands Off!" demonstration against US President Donald Trump and Elon Musk, at Trafalgar Square, in London, Saturday, April 5, 2025 (AP)

UK wealth managers have reported a sharp increase in inquiries from US-based investors concerned about the actions of Donald Trump and his administration, with many seeking to move their wealth from the US to the UK, the Financial Times reported on Sunday.

Firms such as Rathbones, RBC Brewin Dolphin, Evelyn Partners, and Schroders Cazenove told the Financial Times that a growing number of US clients were looking to relocate a larger portion of their wealth to the UK, with some already having done so.

Toby Glover, CEO of Schroders US Wealth Management in London, stated that there had been “a significant increase in new client enquiries, and assets” over the past year, with a “very noticeable uptick over the first three months of this year.”

Nick Ritchie, senior director at RBC Wealth Management, noted that inquiries from US clients were “markedly higher” than during Trump’s first term. Many clients were looking to transfer “between 5 and 50 percent” of their wealth to be managed in the UK or the Channel Islands, with the majority opting for the lower end of that range. The main driving factors behind this move were “safety and security concerns.” Ritchie also mentioned that some wealthy clients had gone further by moving assets into trusts instead of holding them in personal names, providing “an extra layer of protection.”

'A getaway money'

James Blosse-Lynch, an investment director at Rathbones, referred to this money movement as “getaway money,” sharing an example where a client shifted a quarter of their wealth to be managed in the UK, a significant increase from previous holdings. He added that while it was still “early days” in the new presidency, discussions with other clients were “gathering momentum.”

The surge in inquiries follows the announcement of new US tariffs by the Trump administration, which caused $5.4 trillion in stock market losses over two days.

Roy Clouse, senior investment director at Canaccord Wealth, explained to the Financial Times that “there’s a growing concern that the president is operating further and further outside the existing rules and conventions, and could change legislation affecting the ability of investors to invest in foreign markets and currencies.”

At the same time, the UK is seeing a shift, with some wealthy individuals leaving due to changes in the country's tax laws, specifically the abolition of the “non-dom” system. Nick Reeves, a financial planner at Evelyn Partners, pointed out that while many wealthy international individuals are leaving the UK, “we’ve definitely had more queries from Americans.” He added that one of his clients sought to move assets out of the US legal system to purchase UK property in case of potential asset seizures.

The UK has replaced non-dom status with a tax exemption for foreign income and gains for new residents during their first four years, provided that they have been non-residents for the previous ten years. After four years, these residents must pay tax on worldwide income and gains.

Some advisors believe that individuals are using the UK as a temporary “car park” while considering other long-term options, such as moving to Italy, Switzerland, or Dubai. Ritchie commented, “The UK may be acting as something of a car park” as clients explore other possibilities.

4 Min Read

4 Min Read