Why Trump's tariffs risk undermining US AI, chipmaking goals: FT

Even minor components sourced abroad can delay massive data center projects like the $500 billion Stargate initiative led by OpenAI, Oracle, and SoftBank.

-

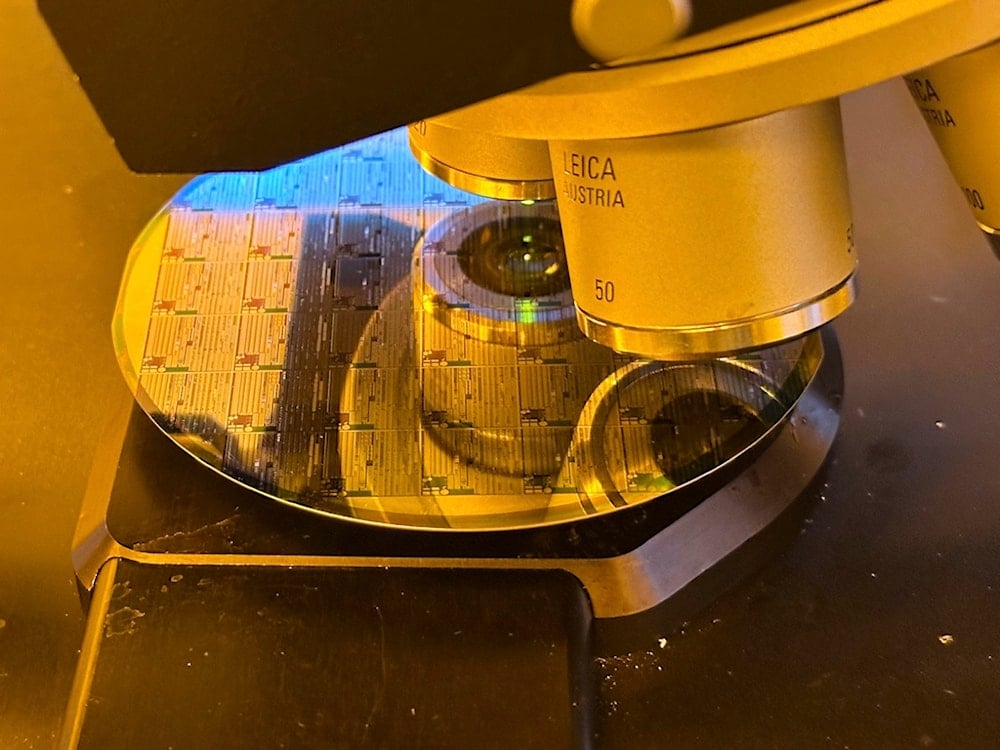

A semiconductor silicon wafer fabricated with multiple microchip microprocessors is at the school of microelectronic engineering at the Rochester Institute of Technology in Henrietta, N.Y., on Monday, April 14, 2025 (AP Photo/Ted Shaffrey)

Donald Trump's aggressive tariff agenda may jeopardize his goal of turning the US into a global leader in artificial intelligence and domestic chip production, according to a report by the Financial Times.

Industry executives and analysts warn that rising costs and supply chain disruptions, caused by high tariffs, especially on Chinese imports, threaten efforts to expand US-based computing infrastructure. These hurdles come just as tech giants like Microsoft, Amazon, Meta, and Google plan to invest $300 billion in AI data centers in 2025.

"The economic uncertainty induced by Trump tariffs could become the single largest barrier to American AI supremacy," said Sravan Kundojjala of consultancy SemiAnalysis.

While Taiwan Semiconductor Manufacturing Company has pledged $100 billion to expand US chipmaking capacity, those projects rely on a global network of suppliers. Even minor components sourced abroad can delay massive data center projects like the $500 billion Stargate initiative led by OpenAI, Oracle, and SoftBank.

Read more: Trump exempts key Chinese electronics from harsh tariff regime

Tariffs — some as high as 145 percent on Chinese goods — have inflated construction and operating costs. Research group Altana estimates China-specific tariffs alone could raise annual US data center costs by over $11 billion.

Adding further uncertainty, the US has launched a Section 232 investigation to examine national security risks tied to importing semiconductors and electronics. The process could take up to 270 days and may result in new restrictions or tariffs.

Even if some chip imports are exempt, analysts say the global nature of semiconductor manufacturing means costs will still rise. AI GPUs, often produced in Taiwan or South Korea, are tested, packaged, and assembled across multiple countries before arriving in the US, typically integrated into servers or devices.

"The threat of the US kneecapping itself in the ability to rebuild onshore manufacturing is real," said Kundojjala.

2 Min Read

2 Min Read