China's export growth beats forecasts as global demand offsets US drop

China’s exports rose 7.2% in July, driven by EU and ASEAN demand, offsetting a sharp drop in US-bound shipments amid ongoing trade tensions.

-

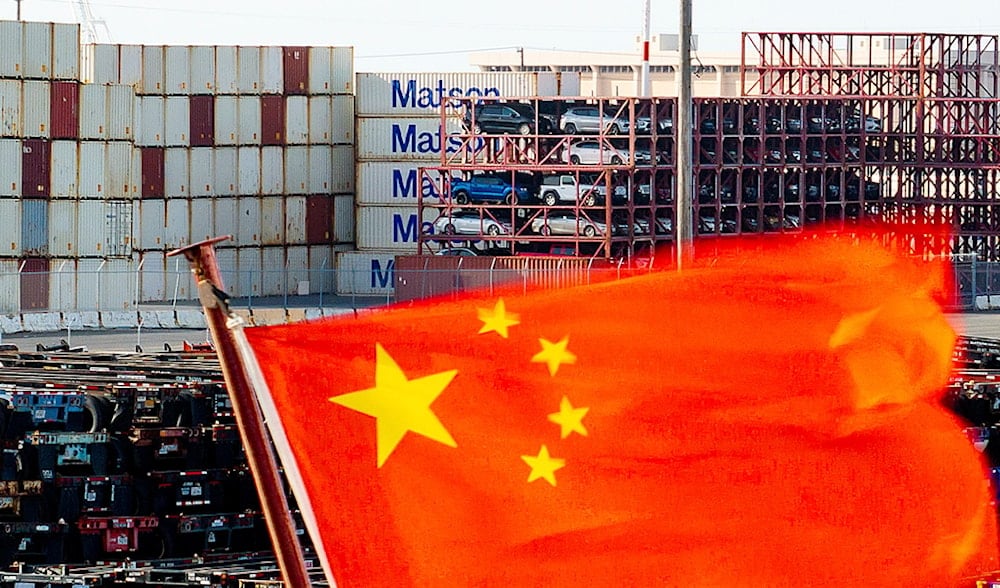

A Chinese flag waves on a ship at the port of Oakland, California, on Tuesday, April 15, 2025. (AP Photo/Noah Berger)

China’s exports rose more than expected in July, buoyed by strong demand from the European Union and Southeast Asia, according to official data released Thursday. The 7.2% year-on-year increase outperformed economists’ expectations of a 5.6% gain, based on a Bloomberg survey.

The robust trade performance offers a temporary boost to Beijing as it navigates persistent domestic economic challenges and ongoing trade frictions with Washington.

Shipments to the European Union jumped by 9.2%, while exports to the Association of Southeast Asian Nations (ASEAN) surged 16.6%. Southeast Asia and China share tightly integrated supply chains, with the region serving both as a production hub and a re-export corridor.

These gains helped offset a significant contraction in exports to the United States, which plummeted 21.7% year-on-year. The decline reflects the impact of US tariffs under former President Donald Trump, which, though reduced from initial levels, remain a major drag on bilateral trade.

The drop in US-bound goods underscores the ongoing strain in US-China trade relations, despite recent efforts to de-escalate. Washington has long accused Chinese exporters of "transshipping" through third countries to bypass tariffs, a practice Beijing denies.

Imports rise despite weak consumption

In a surprise development, China’s imports rose 4.1% in July, defying expectations of a 1% decline. The uptick suggests possible inventory restocking or sector-specific demand, though economists remain cautious.

Zhiwei Zhang, president and chief economist at Pinpoint Asset Management, noted that “exports supported the economy strongly so far this year,” but warned that the momentum may slow. “The big question is how much China's exports will slow and how it would spill over to the rest of the economy,” he added.

Simultaneously, recent data revealed that factory output shrank for the fourth consecutive month in July, further signaling weakness in the export-dependent industrial sector. The contraction adds pressure on Chinese policymakers already grappling with sluggish consumption, a property sector debt crisis, and high youth unemployment.

US-China trade outlook

Beijing and Washington remain in sensitive negotiations over tariffs. The two sides agreed in May to a 90-day trade truce, which was extended last month during talks in Stockholm. The agreement, set to expire on August 12, has temporarily capped new US duties at 30%, while Beijing’s retaliatory tariffs stand at 10%.

US Trade Representative Jamieson Greer claimed that Trump would have the “final say” on any decision to extend the truce.

In a broader reshaping of trade policy, Washington also imposed new tariffs, 35% in the case of Canada, on dozens of countries as part of Trump’s effort to prioritize domestic production.

Read more: US, China agree to push for tariff pause extension as deadline nears

Forecasts for export slowdown

Analysts warn that China’s export performance may weaken in the coming months. Zichun Huang, China economist at Capital Economics, cautioned that while July’s import growth was notable, it may have been driven by stockpiling rather than a broader rebound in domestic demand.

“Exports look set to remain under pressure in the near term,” she wrote in a research note.

Beijing has set an annual GDP growth target of around 5%, but faces headwinds from weak consumer spending and a fragile property market. While foreign demand has offered temporary relief, policymakers may need to lean more heavily on domestic stimulus to sustain recovery.

Read more: Chinese tech continues to accelerate after DeepSeek’s AI breakthrough

4 Min Read

4 Min Read