FT: Why oil sanctions are no longer effective

Analysis shows that despite $1.9 trillion in economic losses, US oil sanctions failed to alter Iranian or Russian policy and instead expanded China’s influence in global energy.

-

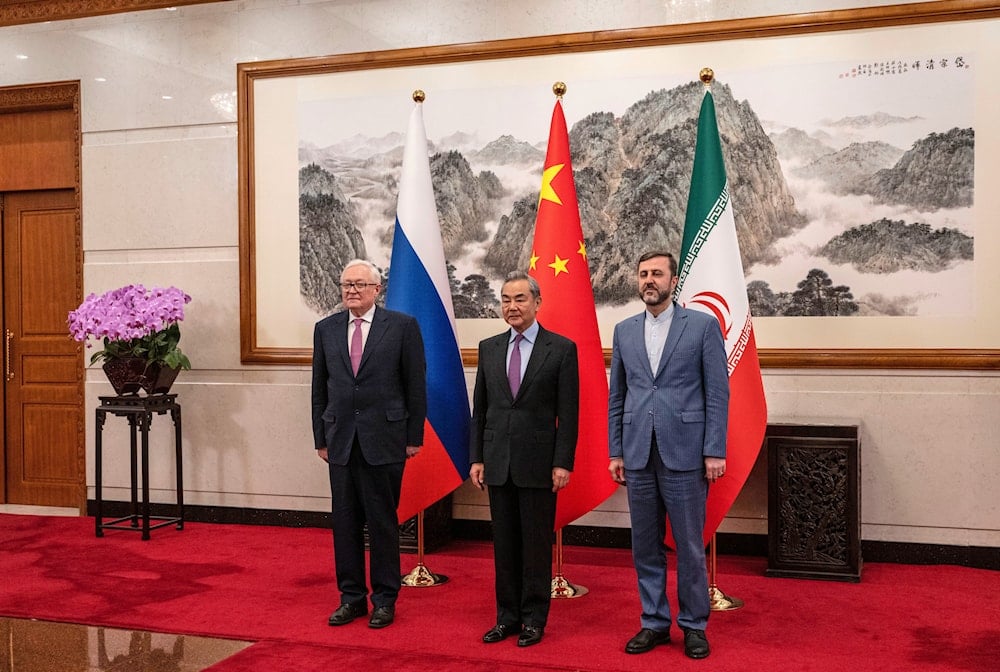

Chinese Foreign Minister Wag Yi, stands with Russian Deputy Foreign Minister Sergey Ryabkov, left, and Iranian Deputy Foreign Minister Kazeem Gharibabadi, right, before a meeting regarding the Iranian nuclear issue at Diaoyutai State Guest House on March 14, 2025 in Beijing, China. (Pool Photo via AP)

In an article for the Financial Times, Gregory Brew, an analyst with Eurosia Group's Energy, Climate & Resource team who specializes in the geopolitics of oil and gas, argues that modern oil sanctions have lost their potency as instruments of economic coercion.

Rather than altering state behavior, sanctions have benefited geopolitical players like China while failing to produce intended political shifts. Despite inflicting heavy economic costs, approximately $1.2 trillion for Iran and $750 billion for Russia, sanctions have not achieved their core objectives. Consequently, Brew calls for a strategic reassessment of US foreign policy tools.

Oil sanctions were initially designed to compel states into compliance through economic pressure. In theory, severe economic disruptions are thought by policymakers as capable of forcing policy changes. However, as Gregory Brew highlights, the experiences of Iran and Russia reveal a different reality. Iran’s GDP shrank by 16% annually between 2012 and 2015, with citizens losing an average of $14,000 in income over 12 years. Russia’s economy might have been 20% larger without sanctions, with 70% of its banking assets now under restrictions.

Despite these burdens, both nations have remained steadfast in their strategic and governing objectives, weathering US attempts to undermine their sovereignty. Iran resisted US demands on its nuclear program, and Russia continued its war with Ukraine. The presumed correlation between economic hardship and political compliance has effectively collapsed.

Iran’s oil exports adapt to sanctions

Following Washington’s exit from the 2015 nuclear agreement, Iran’s oil exports decreased, exacerbated by the COVID-19 crisis. Still, the market did not vanish. Instead, it evolved. Brew illustrates how China began importing nearly 2 million barrels per day of Iranian crude, elevating its reliance on Iran to 14.6% of total oil imports. This shift illustrates how the global oil market adapts to sanctions rather than succumbing to them.

Brew identifies Chinese "teapot" refiners, operating outside Western financial networks, as pivotal buyers of sanctioned oil. In doing so, Beijing concealed its dealings with Tehran through opaque customs reporting. Iran’s economy, heavily impacted across agriculture, industry, and services, with sector losses estimated at $150 billion, $450 billion, and $600 billion, respectively, now operates through a sanctions-resistant framework.

Russia’s energy sector and western sanctions

The 2022 US-led sanctions on Russia emphasized financial tools, including the G7 price cap, intending to limit revenue without curbing exports. This approach, as Brew explains, deprived Moscow of over $500 billion through frozen reserves and lost energy revenue.

However, the outcome mirrored Iran’s experience. Despite losing $170 billion from direct financial restrictions and $400 billion from energy losses, Russia continued to finance its operations. GDP fell by 2.1% in 2022, only to grow by 3.6% in 2023 and 4.1% in 2024. Albeit, this subsequent growth mainly stemmed from war spending rather than economic recovery. Meanwhile, India and China capitalized by purchasing discounted Russian crude, profiting from reexports, particularly to European markets.

According to Brew’s analysis, the real winner from oil sanctions has been China. By absorbing sanctioned oil at lower prices, it has positioned itself as the central player in a bifurcated global oil system. Both Iran and Russia now depend on Beijing, granting China substantial strategic leverage and discounted access to vital energy resources.

Rethinking US foreign policy

Gregory Brew recommends a pivot in US strategy. Rather than doubling down, Washington should reassess the effectiveness of oil sanctions. Targeted sanctions remain useful for limiting specific entities within Western financial systems, but broad sanctions have failed to alter adversarial policies.

He cautions that full-scale sanctions on China would backfire. As the world’s top oil importer, penalizing Chinese trade would destabilize US energy markets and harm American producers. Instead, he encourages gradual decoupling via tariffs and export controls, in coordination with allies.

As Brew concludes, sanctions have restructured, not suppressed, oil markets. Iran and Russia continue to export significant volumes through alternative routes, particularly to China. The geopolitical map of energy has shifted, and traditional tools of economic coercion are now blunt instruments.

4 Min Read

4 Min Read