Trump’s weak dollar strategy risks global fallout: Forbes

As Trump pushes for a weaker dollar during his Asia trip, analysts warn the move could backfire, echoing Japan’s economic stagnation and risking damage to the US' global standing.

-

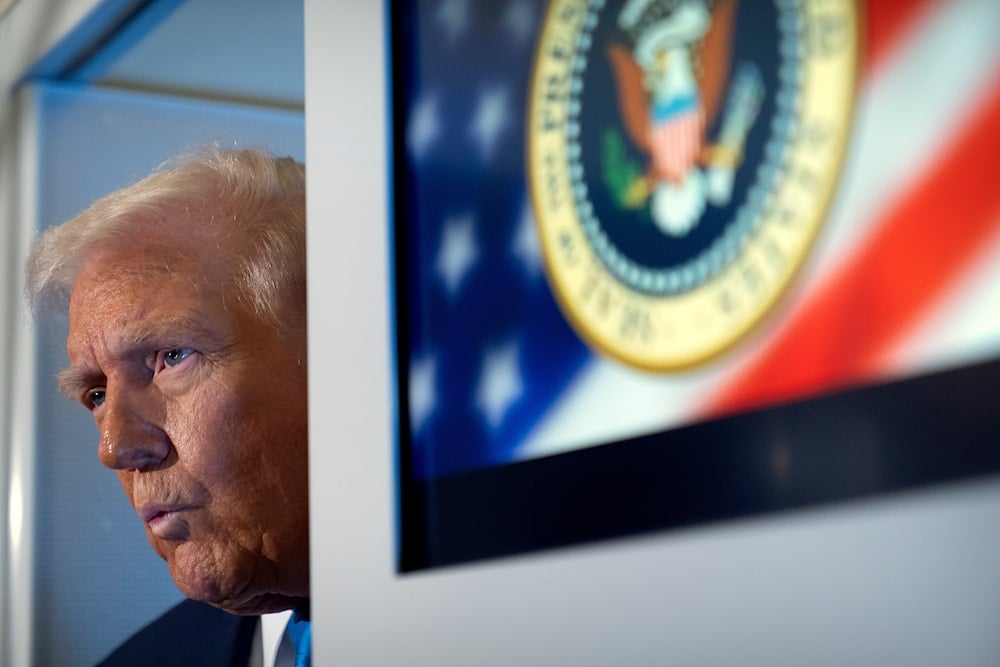

US President Donald Trump speaks to reporters aboard Air Force One as he travels from Tokyo, Japan, to South Korea on October 29, 2025. (AP Photo/Mark Schiefelbein)

As US President Donald Trump tours Asia, one theme underlies his messaging, even when unspoken: a desire for a weaker US dollar. From Kuala Lumpur to Tokyo and Seoul, Trump's agenda includes tariffs, investment promotion, and security. Yet at every stop, his administration's long-standing pressure for a lower US dollar exchange rate looms large.

An article published by Forbes on Wednesday, written by William Pesek, states that despite this push, the countries Trump is visiting offer clear examples of the dangers of manipulating currency values, particularly Japan. For decades, Japan’s export-driven growth relied on a weaker yen. But over the past 25 years, this approach has stunted innovation and delayed necessary reforms.

Instead of revitalizing the economy, the yen’s artificial weakness fueled complacency in both government and corporate boardrooms.

According to Pesek, the Bank of Japan’s persistent reliance on monetary easing, through repeated interest rate cuts and expansive quantitative easing (QE) since the late 1990s, led to a substantial depreciation of the yen. Under the banner of Abenomics in 2013, the currency declined by 30% against the US dollar, temporarily lifting GDP figures and equity markets. However, this strategy failed to deliver sustainable improvements in productivity, economic efficiency, or Japan’s integration into the global innovation economy.

Japan’s prolonged stagnation illustrates a broader lesson: currency devaluation, when used as a substitute for structural reform, ultimately undermines long-term economic resilience and competitiveness.

Abenomics and the illusion of competitiveness

The report mentions that the economic policy package known as Abenomics, introduced by then-Prime Minister Shinzo Abe, was meant to reboot Japan’s economy, promising aggressive monetary easing, fiscal stimulus, and structural reform, Pesek wrote, adding that, in practice, it leaned heavily on the first two and largely stalled on the third.

Abe had political capital, popularity, control of both houses of parliament, and nearly eight uninterrupted years in power, but did not enact the deep reforms needed to restore Japan’s dynamism. Today, wages lag inflation, productivity gains are minimal, and China is gaining global market share, filling the vacuum Japan failed to address.

Trump’s desire for a weaker dollar ignores the "exorbitant privilege" the US enjoys through dollar dominance and low-yield Treasury borrowing. Undermining the dollar could shake investor confidence in US assets, pushing up yields and weakening demand for Treasury securities, a serious risk in an economy carrying over $38 trillion in debt.

According to Pesek, while Trump aims to boost exports, he risks destabilizing the very financial foundation that gives the US global influence. He added that, unlike Japan, the US dollar is the linchpin of global trade and finance, and any move to deliberately devalue it could backfire.

Trump’s attacks on the Federal Reserve raise global concerns

The article mentions that compounding this risk is Trump’s continued assault on the Federal Reserve, adding that no US institution commands greater global respect than the Fed, which safeguards the dollar and Treasury markets. Yet Trump has labeled Chair Jerome Powell a “fool,” “low IQ,” “moron,” and “stiff.”

Such rhetoric not only undermines the credibility of the Fed at home but also sends shockwaves across global markets, but Trump’s pressure to reduce rates or pursue a weaker dollar path shows disregard for institutional independence, further spooking international observers.

While Trump may believe a weak dollar levels the playing field, history suggests otherwise. As Japan’s experience shows, currency devaluation does not substitute for economic innovation and reform. Moreover, China, now a dominant force in global trade, has studied Japan’s trajectory closely, knowing that the yuan's rise could threaten its export base, just as the 1985 Plaza Accord preceded Japan’s lost decade.

Trump’s desire for a weaker dollar is unlikely to sway Beijing. In fact, his erratic economic policies and disregard for diplomacy diminish the chances of any credible "Mar-a-Lago accord" on currency. "Who in Beijing would trust Trump World to keep its part of the bargain?" While tariffs and tough talk make headlines, Trump’s push to weaken the dollar may be the most self-destructive policy of all, one that undermines not only the US economy but the very system it leads, explained Pesek.

4 Min Read

4 Min Read