UK household gas and electric debt at $3.8 billion, highest level ever

British debts have increased by £400 million since mid-October, recording their highest level ever because of a combination of high energy prices and bigger cost of living pressures.

-

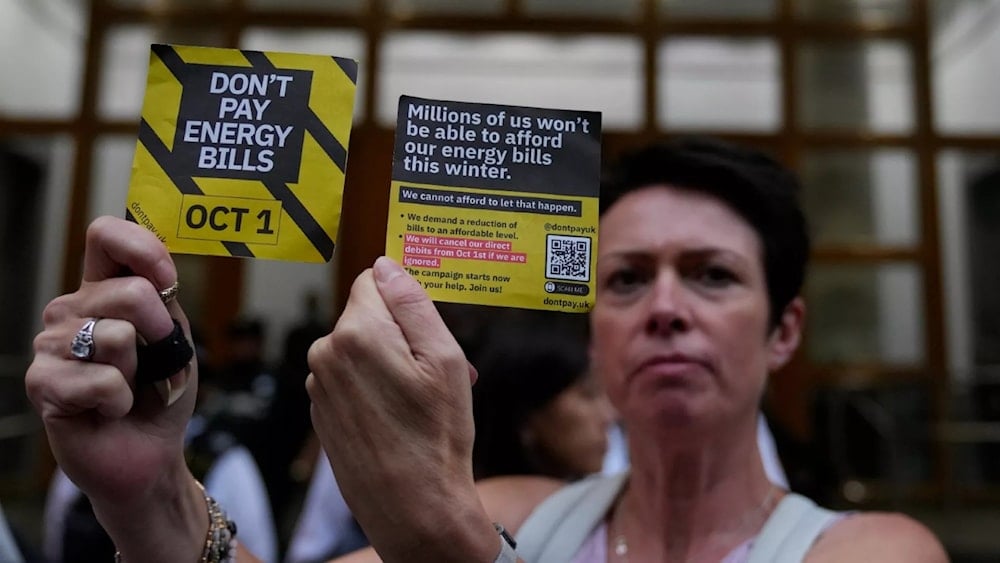

A demonstrator holds up two protest cards amid a protest outside the British energy regulator Ofgem (AP)

As reported by the UK's national energy regulator Ofgem, UK households have accumulated debts on electricity and gas supply of around £3 billion ($3.8 billion) with electricity and gas suppliers - increasing by £400 million ($507 million) since mid-October, and recording their highest level ever because of a combination of high energy prices and bigger cost of living pressures.

In an attempt to protect the energy market and consumers from the increasing crisis, a one-off price cap adjustment of £16 (almost £1.33 a month) was announced by the regulator to be paid between April 2024 and March 2025. Ofgem justified its decision by saying it was critical to ensure suppliers were “resilient” and still able to help those in need of support.

Tim Jarvis, the director general for markets at Ofgem, said, “We know that cost of living pressure is hitting people hard and this is evident in the increase in energy debt reaching record levels,” adding, “The record level of debt in the system means we must take action to make sure suppliers can recover their reasonable costs, so the market remains resilient, and suppliers are offering consumers support in managing their debts”.

However, Ofgem’s plans backfired with criticism from some campaigners saying energy suppliers are still making money while consumers are struggling with bills.

Read more: Inequality in the UK costs $161.8bn, rich are top 1% protected group

The Guardian cited Simon Francis, coordinator of the End Fuel Poverty Coalition, as saying, “This outrageous tax on energy consumers is simply not fair”.

“Energy suppliers have posted billions in profits already this year while millions of people struggle in cold damp homes. The record levels of energy debt are due to Britain’s broken energy system, not the fault of the hard-pressed public,” Francis added.

'Greedflation' issues

Grocery prices have also seen an increase, causing further outrage among the public as a result of the high cost of living.

As outlined in a report earlier this month by the UK Competition and Markets Authority (CMA), numerous well-known grocery suppliers have been raising prices beyond their production costs, leading to what is described as 'greedflation'.

Within the food and groceries industry, the CMA identified that substantial inflation is primarily attributed to escalating input costs, notably in energy and crucial agricultural commodities such as fertilizer.

Sarah Cardell, the chief executive of the CMA, emphasized the significance of addressing competition issues amid the considerable strain food price inflation has imposed on household budgets. She pointed out that while leading brands have generally increased prices beyond their cost hikes, own-label products often offer more economical alternatives.

Back to 'desperate measures'

Even back in November, the Joseph Rowntree Foundation (JRF) charity reported that around 2 million households reached a point where they are turning their fridges off to save money amid a “frightening” level of hardship for the first time since May.

The JRF stated that four out of five households on universal credit were going without food, turning off the heat, not replacing worn-out clothing, and resorting to “desperate measures”.

The JRF noted that although the government allocated over £12 billion for the cost of living support, 7.3 million households have still gone without food and other essentials in the last six months.

4 Min Read

4 Min Read