Lebanon's Central Bank concealed commission receivers

Lebanon's Central Bank did not disclose to commercial banks that a bulk of their paid commissions would go to a company controlled by Riad Salameh's brother.

-

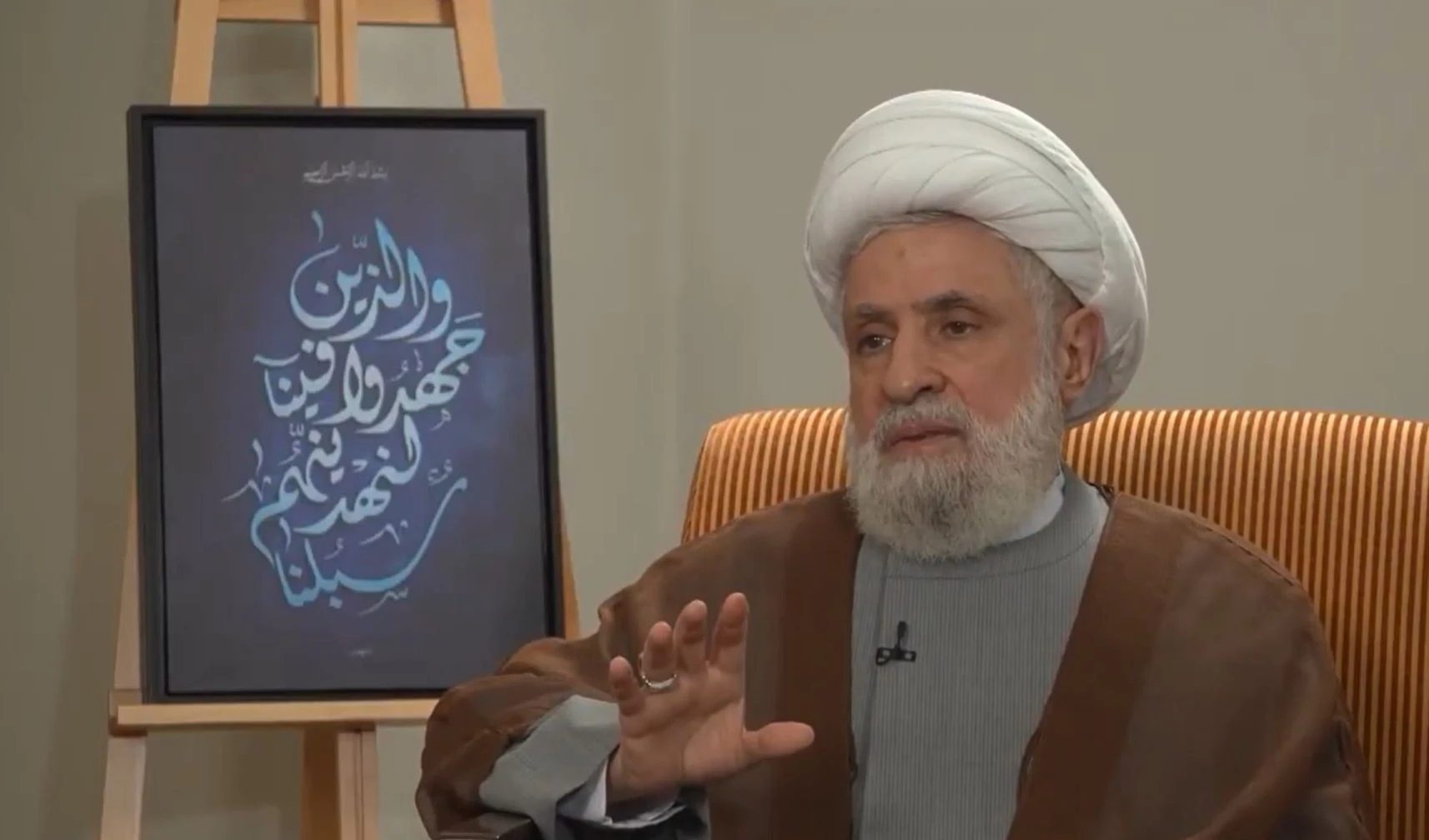

Riad Salameh (Reuters)

According to papers obtained by Reuters, Lebanon's Central Bank charged fees to commercial banks when they purchased government assets for more than a decade, without disclosing that the majority of those payments went to a business run by the governor Riad Salameh's brother.

Salameh has been the governor of the central bank for 29 years. He has recently been blamed for the plunging of the value of the Lebanese pound after Lebanon's financial crisis began in 2019.

Four contracts obtained by Reuters, from 2004 to 2014, between Banque du Liban (BDL) and a Lebanese commercial bank, show that the bank entering into the deal committed to pay 3/8 of 1% commission on purchases of government certificates of deposit worth millions of dollars. According to two top executives in the finance sector, such contracts were common for commercial banks making similar deals at the time.

The contracts contained no mention of Forry Associates, a firm managed by Raja Salameh, the brother of central bank governor Riad Salameh.

In an interview for Reuters in November, Riad Salameh revealed that his business eventually earned such commissions.

Riad told Reuters Forry's "only job was to gather all these commissions and fees and redistribute according to the instructions."

Salameh stated that the commissions were transparent and sanctioned by the central bank's board. The commissioners and their whereabouts are being investigated in Europe and Lebanon.

According to a letter the Swiss attorney general wrote to Lebanese officials last year, Swiss police think the Salameh brothers illegally took more than $300 million from BDL between 2002 and 2015, laundering part of the money in Switzerland.

Salameh rejects any wrongdoing, claiming that none of the commission money belongs to the central bank, which is a publicly held organization.

He told Reuters that the commissions were placed into a "clearing account" at the central bank before being remitted to Forry. He stated that he had contacted the audit company BDO Semaan, Gholam & Co to investigate the problem. He refused to show Reuters the auditor's examination regarding the account.

Three contracts with the central bank's letterhead state in Arabic: "We authorize you to deduct a commission of 3/8 of 1%," where "you" refers to the central bank. Forry is not referenced in any of the contracts.

Five persons with firsthand knowledge of such contracts who now or previously held significant positions in the Lebanese banking sector told Reuters they had never heard of Forry before the Swiss probe was disclosed last year.

According to experts, it is fairly uncommon for central banks to impose charges on certain transactions. However, the fee money is normally sent directly to central banks to assist them in supporting operations and lessening their reliance on government financing. They argue that sending commissions to other parties would be uncommon and would contradict the objective of charging such fees.

Mike Azar, an expert on Lebanon's financial system and former economics professor at Johns Hopkins University, says, "These are clearly public funds, because if the commission wasn't paid" to Forry, "the central bank would've gotten a better deal" by receiving the fee itself.

Aoun: Riad Salameh accused of ignoring financial misconduct probe

Lebanese President Michel Aoun said that suspicions are increasing regarding Lebanese Central Bank Governor Riad Salameh after he neglected to provide management and consulting firm Alvarez and Marsal with documents, noting that his failure to cooperate has cost us $150,000 in penalties.

Speaking to Lebanon's Al-Akhbar newspaper, Aoun said that it is unnatural for the Central Bank to refuse to provide the firm with the documents, stressing that Salameh is now being investigated and that the matter is no longer one him obstructing political decision-making, rather that he is not complying with it.

He went on to say that more than one country has requested info on Salameh's assets, the first being Switzerland. France followed suit, demanding legal aid in investigations against Salameh, then the UK, then Germany, then Luxembourg, and Belgium.

Banned from traveling

Lebanese judge and Mount Lebanon's State Prosecutor Ghada Aoun issued on January 11 a travel ban against the country's Central Bank Governor Riad Salameh over a lawsuit accusing him of financial misconduct.

A judicial source told AFP the ban is pursuant to a lawsuit filed by an activist group against Salameh over financial misconduct.

Aoun confirmed to Al Mayadeen that she would continue pursuing Salameh until he is brought to justice.

5 Min Read

5 Min Read