New BRICS currency set to revolutionize world economy: The Post

A report by The Post points to the importance of the 15th annual BRICS summit, as the possibility of the introduction of an alternative trade currency puts observers on edge.

-

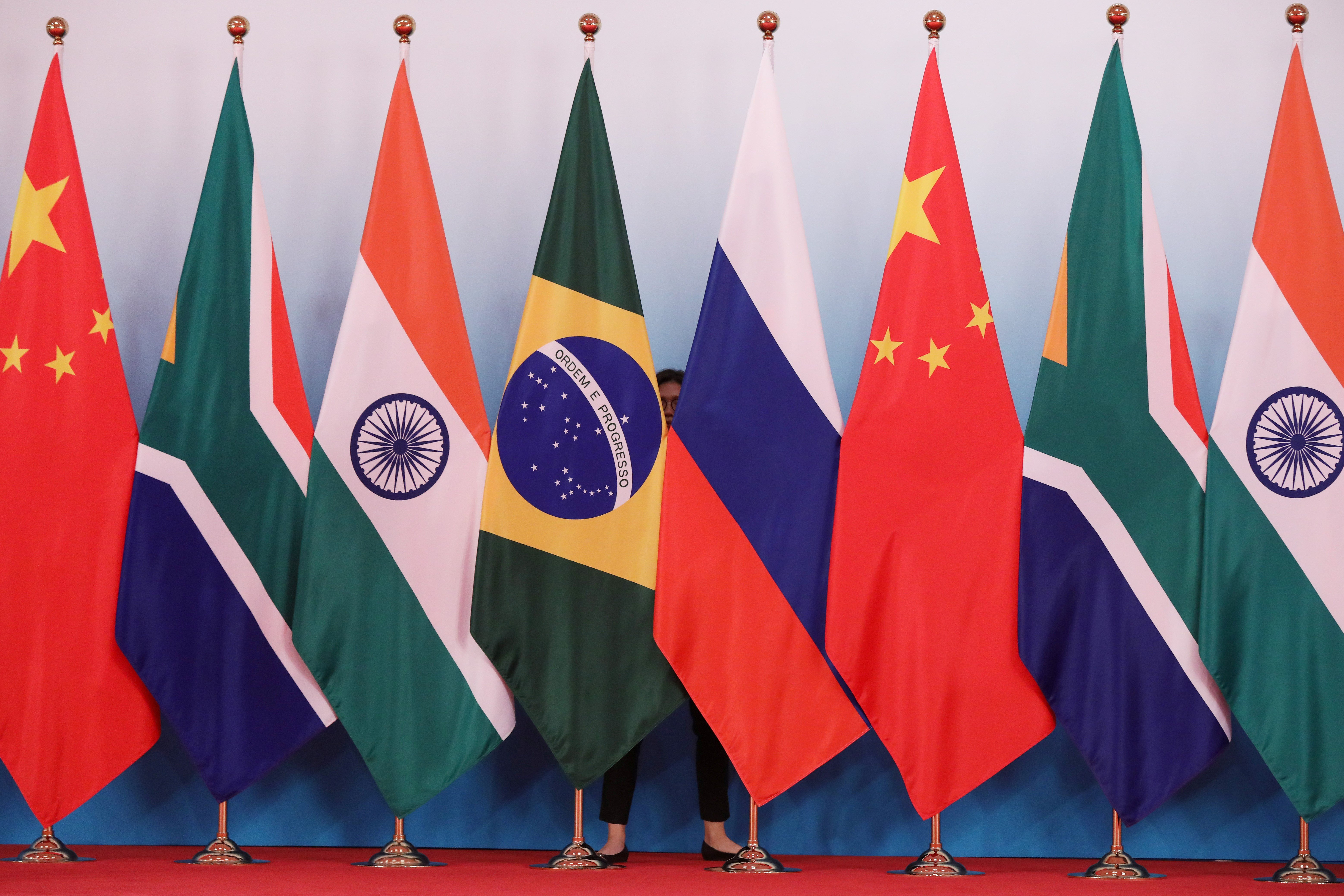

The national flags of China, South Africa, India, Russia, and Brazil are put up ahead of a group photo of the participants in the BRICS summit, Xiamen, China, September 4, 2017 (Reuters)

The 15th annual BRICS summit, set to take place in Cape Town South Africa, is speculated to bring drastic changes to the world economy, as its member states seek to strengthen financial multipolarism, a report by The Post explained.

The arrest warrant against Russian President Vladimir Putin has headlined reporting on the event in Western media outlets, which have downplayed the importance of the summit and its impact on global financing.

South Africa has already made the necessary assurances to diplomats attending the proceedings as it has provided diplomatic immunity for attendees of the event, including President Putin.

The Indian Minister of External Affairs Subrahmanyam Jaishankar brought to light the general intentions of the member states that are aiming to "send out a strong message that the world is multipolar, that it is rebalancing and that old ways cannot address new situations."

The Post highlighted the possibility of introducing a new trade currency bill that challenges the dominance of the US dollar in international transactions, hence the Western downplay of any event related to BRICS.

According to reports emerging from Cape Town, the New Development Bank (NDB), which hosts several countries of the Global South and offers alternative developmental projects, will be central to the success of the new currency. This would position the financial institution in a place where it can compete with the Western-controlled International Monetary Fund (IMF), The Post said in its report.

Anton, Siluanov, the Russian Finance Minister, said the currency would be more of a "payment unit inside the BRICS countries," rather than an alternative to the US dollar, which has taken several blows this year as countries have sought to diversify payment methods in 2023.

The analysis compares the awaited currency to that of the pre-Euro European Exchange Rate Mechanism that aimed to reduce exchange rate variability between European states by offering a peg to their individual banknotes.

The NDB, also known as the "BRICS bank", was set up in 2012 at the fourth summit of the five regional economies. The institution was expected to play a role similar to that of the World Bank but is now expected to take an expanded financial role, outside of providing funds for developmental projects, akin to the business done by the IMF.

The Post pointed to the importance of the NDB's headquarters in Shanghai, China. For the publication, this underlines the crucial role Beijing plays in leading the "multipolar revolution" as it provides the economic coalition with the necessary elements to carry out the process.

Read more: BRICS ministers discuss plans to form alternative global currency.

3 Min Read

3 Min Read