Syria receives Russian banknotes to ease cash shortage: FT

Foreign Minister Asaad al-Shaibani told the Financial Times last month that, under the Assad government, Syria regularly ordered printed currency from Russia as needed.

-

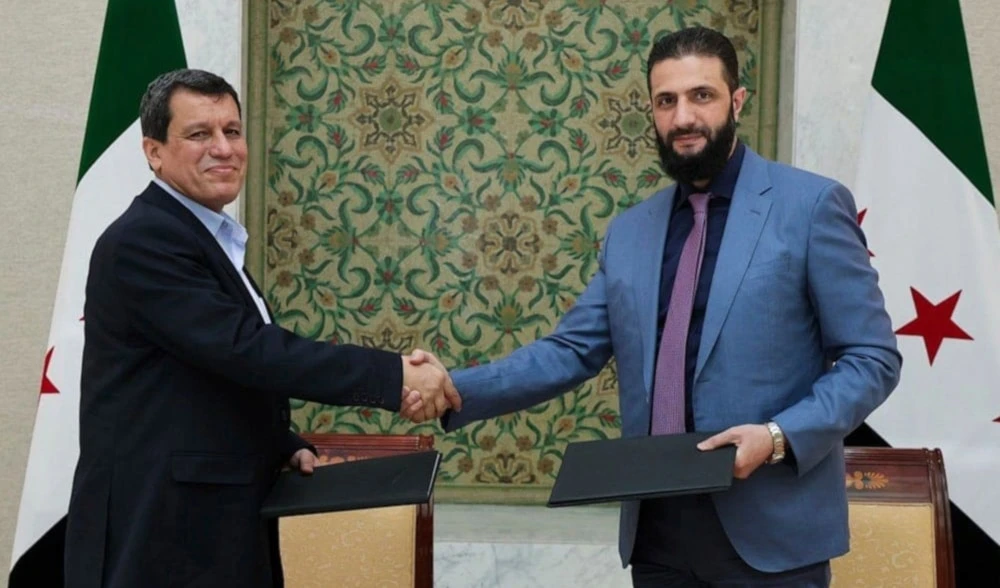

Syrian banknotes (Agencies)

The Financial Times on Friday reported that Syria's central bank has received a shipment of newly printed banknotes from Russia to address an acute cash shortage that has severely disrupted the economy. The central bank confirmed the arrival of the currency via Damascus International Airport but declined to specify the amount. Businesses and bankers have warned that the scarcity of cash has made daily transactions increasingly difficult.

The development indicate Syria's continued reliance on Russia for financial support, particularly as Western sanctions prevent the country from obtaining banknotes from European suppliers. This dependency has deepened under the newly formed government, which, like the previous administration, must source its printed currency from Moscow.

A Syrian textile manufacturer and retailer described the crisis, saying, "People have stopped putting money in the bank because they worry they can't take it out." Rumors about the banknote shipment had circulated online for days, prompting the central bank to clarify that "the figures circulating about the size and quantities of this money" were "completely inaccurate" without disclosing any specific details.

Foreign Minister Asaad al-Shaibani told the Financial Times last month that, under the al-Assad government, Syria regularly ordered printed currency from Russia as needed. Goznak, the Russian state-owned printing company, remains the primary supplier of Syrian banknotes. With Western firms unwilling to provide currency due to ongoing sanctions, Syria has little choice but to continue working with Russia.

The cash shortage has sparked speculation about whether the government intends to withdraw certain banknotes from circulation. One of the most commonly used denominations, the 2,000 Syrian pound bill, bears an image of former president Bashar al-Assad, who is now living in Russia.

Read more: Syria seeking 'clear policy' from Russia, Iran: FM

Cash Crunch

Although the central bank lifted its temporary cap on withdrawals at the end of last month, access to cash remains highly restricted. Business owners and retail clients seeking withdrawals from banks are frequently turned away. Two bankers, speaking on condition of anonymity, reported that private banks have been receiving up to 600 million Syrian pounds (about $46,000) per day from the central bank. However, this amount falls far short of what businesses need to maintain operations.

Many traders and manufacturers have been forced to dip into their cash reserves to cover salaries and supplier payments. A banker noted, "Traders have been paying employees from their [cash] reserves, and that has worked for two months, but how much longer could they last?" Some businesses have resorted to transferring funds between banks as an alternative, a system one trader likened to "pseudo bartering."

The extent of Syria's cash crisis is difficult to gauge due to a lack of transparency from the central bank. Unlike many financial institutions worldwide, Syria's central bank does not publish weekly reports on the volume of money in circulation. Its website remains inaccessible, further obscuring information on the country's financial situation.

Adding to the strain, Syria's banking system has long been distrusted by citizens, who prefer to keep their cash outside of banks. This trend intensified in the years leading up to al-Assad's removal when authorities began pressuring private banks to disclose client financial details for ad hoc taxation.

Economic Uncertainty

Syria's economy had already suffered from years of war, corruption, and the impact of international sanctions, particularly on its financial sector. Despite the optimism that followed the regime change, businesses report a sharp drop in sales. Additionally, the lifting of export restrictions has forced some to sell goods at a loss.

"People are not spending because they don't know what's going to happen," a textile businessman said. "Companies are not spending because there's no cash revenue, and the main priority is paying employees."

Read more: Syria announces 400% pay hike for public sector employees amid reforms

Western governments have maintained most sanctions on Syria's banking sector, though some officials, including within the EU, have proposed a gradual easing of restrictions.

"There are a number of signs of confusion and lack of clarity," said Jihad Yazigi, editor of Syria Report. "The economy is a big, big issue… a crucial test for the new authorities in Damascus will be to ensure [a] steady supply of… energy and bread and, more generally, ensuring the economy restarts."

4 Min Read

4 Min Read