China’s Huawei develops new AI chip, seeking to match Nvidia

Huawei is testing its new Ascend 910D AI processor to compete with Nvidia's H100, aiming to strengthen its position in the AI chip market

-

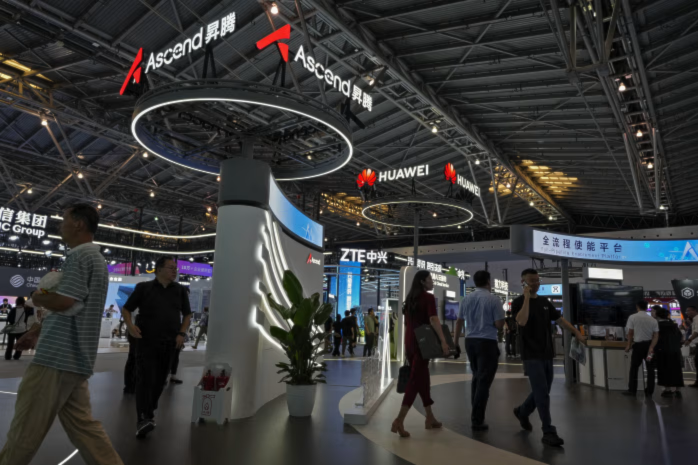

Visitors tour Huawei’s Ascend AI exhibition booth during a conference last year. (Andy Wong/AP)

Huawei is preparing to test its new Ascend 910D AI processor, aimed at competing with Nvidia's H100. Despite US efforts to hinder China's semiconductor industry, Huawei remains resilient, approaching Chinese tech firms for feasibility tests.

The company expects to receive the first batch of samples by late May, but the chip is still in early development, with several tests required before it can be offered to customers. Huawei aims for the 910D to outperform Nvidia's H100, a key AI training chip released in 2022.

If successful, this development could help Huawei strengthen its position in the AI chip market. It also marks a significant step in China's efforts to advance its semiconductor capabilities amid growing tensions with the West.

The Ascend 910D and other Ascend processors are designed for artificial intelligence (AI) applications, particularly in AI training and data processing. These chips are aimed at powering systems in sectors like telecommunications, autonomous driving, and data centers, where high-performance computing is crucial for handling large-scale AI tasks.

Huawei's position in China’s semiconductor industry

Huawei is emerging as China’s leader in AI chip technology, developing alternatives to Nvidia’s chips as part of Beijing's push for a self-sufficient semiconductor industry. Despite being on a US trade blacklist for nearly six years, Huawei successfully released a high-end smartphone, the Mate 60, powered by a locally made processor, surprising the US government.

The company’s new Ascend 910D chip utilizes advanced packaging technology to combine more silicon dies, enhancing performance. While the 910D is power-hungry and less energy-efficient than Nvidia’s H100, it competes directly with Nvidia’s offerings. The US restrictions on Nvidia’s chips open the door for Huawei and other Chinese firms, like Cambricon Technologies, to capitalize on the market.

Huawei’s strategy to overcome challenges and expand production

This year, Huawei is set to ship over 800,000 Ascend 910B and 910C chips to customers, including state-owned telecom carriers and private AI developers like TikTok parent ByteDance.

Following US restrictions on Nvidia’s H20 chips (the company’s most advanced processor allowed for sale in China without a license) some buyers are now looking to increase orders of Huawei’s 910C, with discussions already underway to seize the opportunity.

Despite manufacturing bottlenecks, Huawei and other Chinese chip makers have delivered products comparable to Nvidia’s, using technologies that pack multiple chips together to boost performance. Beijing has encouraged local AI developers and state data centers to purchase more domestic chips, with most chips used by state centers coming from Chinese suppliers.

However, Huawei’s previous chips, such as the 910C, have fallen short of rival Nvidia’s performance, and Huawei still faces challenges in scaling production due to restrictions on access to advanced chip-making equipment.

Huawei caught in the middle of tech rivalry

Washington has blocked China from accessing key components for AI chips, such as the latest high-bandwidth memory units. In retaliation, Beijing has banned the export of several critical materials, including gallium, germanium, and antimony, vital for semiconductor and electric vehicle battery production. Both countries are accusing each other of potential military use with regard to the banned items.

In response, Huawei has focused on building more efficient systems, like the CloudMatrix 384, which connects 384 Ascend 910C chips, offering competitive performance compared to Nvidia’s flagship system, though with higher power consumption.

“Having five times as many Ascends more than offsets each GPU being only one-third the performance of an Nvidia Blackwell,” research firm SemiAnalysis wrote in a report. “The deficiencies in power are relevant but not a limiting factor in China.”

Huawei CloudMatrix 384 vs Nvidia GB200 NVL72?

— SemiAnalysis (@SemiAnalysis_) April 26, 2025

Are Nvidians joining Huawei? pic.twitter.com/UbX7RALtMe

Despite also facing production hurdles, Huawei has managed to deliver products similar to Nvidia's, though they are a few years behind. To address the growing difficulty and expense of shrinking chip circuitry, these companies have turned to methods that integrate multiple chips to enhance processing power.

As Huawei continues to innovate in AI chip development, its efforts reflect China’s drive to advance its semiconductor capabilities amid growing tensions with the US.

4 Min Read

4 Min Read