In first, gold price exceeds $3,000 amid Trump's trade wars

Gold price increases are generally correlated with greater economic and political turmoil.

-

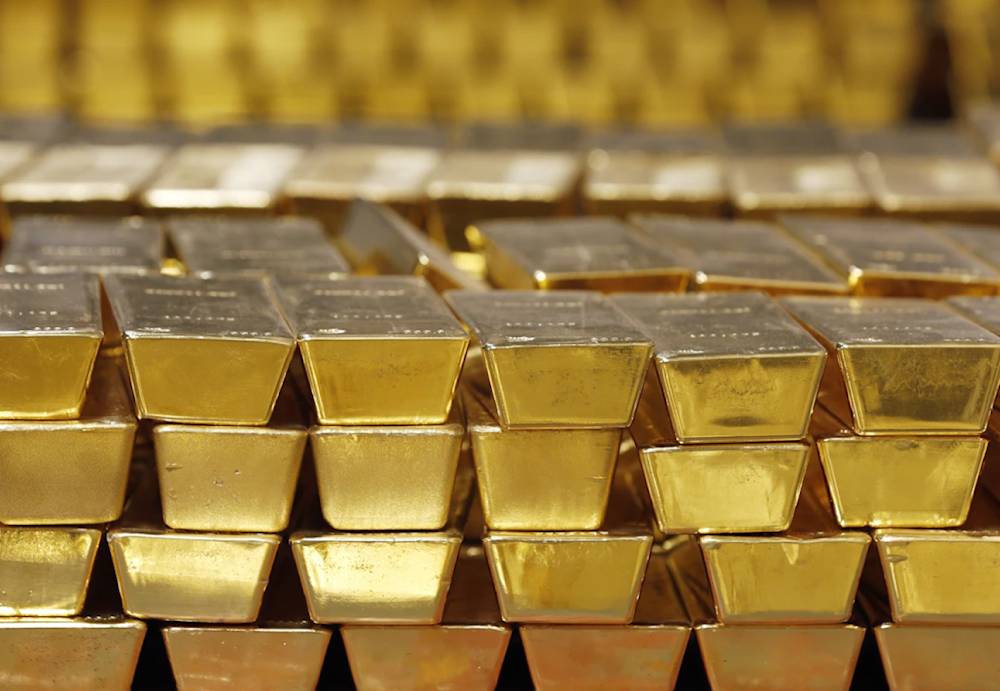

Gold bars are shown stacked in a vault at the US Mint, on July 22, 2014, in West Point, New York. (AP)

Gold prices passed $3,000 an ounce for the first time ever; a rise instigated by a central bank buying spree, economic fragility worldwide, and US President Donald Trump’s trade wars with both allies and strategic rivals.

Bullion rose by up to 0.4% reaching $3,001.20 per ounce on Friday.

The surge above the psychological $3,000 barrier emphasizes gold's centuries-old position as a store of wealth in tumultuous times and a gauge of anxiety in markets.

In the previous quarter century, the price has climbed tenfold, exceeding even the S&P500, the benchmark for US stocks, which quadrupled during the same time period.

As traders braced for tariffs, US gold prices rose beyond other international benchmarks, pushing dealers to rush bullion into America in big quantities before the taxes went into effect.

Between election day and March 12, more than 23 million ounces of gold worth about $70 billion were deposited in New York's Comex futures market depositories. The inflow has been so massive that it helped boost the US trade imbalance to a new high in January.

Gold price increases are generally correlated with greater economic and political turmoil. Gold broke $1,000 per ounce in the aftermath of the financial crisis and surpassed $2,000 during the COVID-19 epidemic.

Prices fell back to $1,600 following the epidemic but began to increase again in 2023, fueled by central banks that purchased bullion to diversify away from the dollar, fearing that the currency would expose them to punitive action from the US.

2 Min Read

2 Min Read