Trump’s tariffs begin to squeeze US shoppers’ wallets: FT

US consumers currently bear around 30-40% of the tariff cost, a share expected to rise to 60% in the coming months.

-

A waiter looks at empty tables at a restaurant, Thursday, September 25, 2025, in Miami Beach, Florida. (AP Photo/Marta Lavandier)

The effect of US President Donald Trump's tariffs is now visibly rippling through the US economy, with consumer goods, from car parts to canned soup, becoming noticeably more expensive. Despite a moderate overall rise in inflation, official data and company statements indicate that the burden of tariffs is increasingly being passed on to consumers.

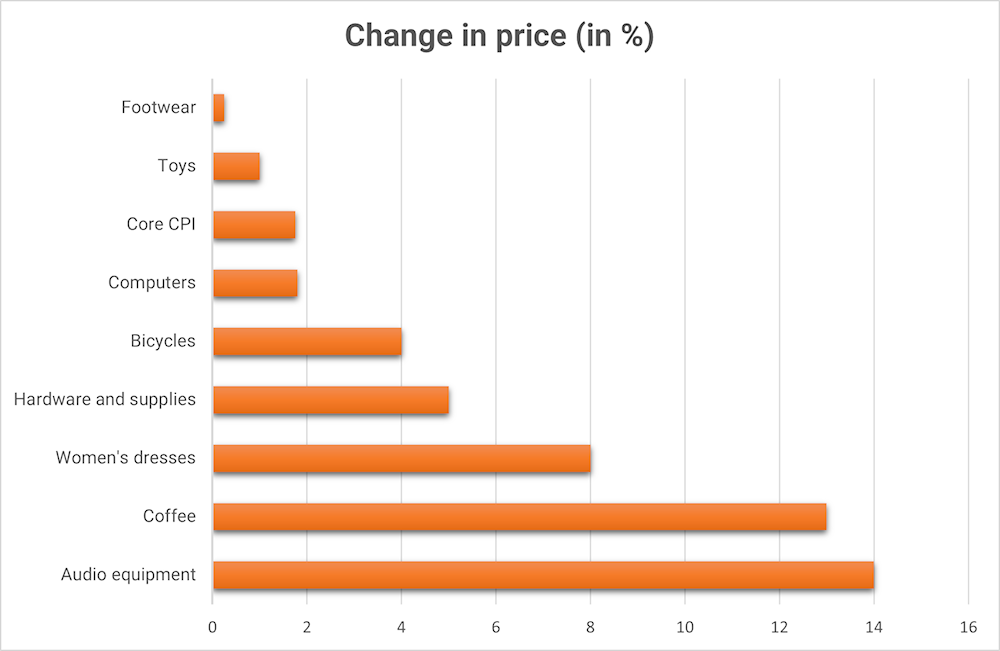

Figures from the Bureau of Labor Statistics show that, over the six months leading to August, prices for several import-heavy products climbed sharply, where audio equipment rose by 14%, dresses by 8%, and tools and hardware by 5%. Most of these items are sourced from abroad, meaning the cost of tariffs is now translating into higher prices on store shelves.

"Over the past two years, goods inflation has been about zero. We are beginning to see goods inflation creep up," Mark Mathews, chief economist at the National Retail Federation, told The Financial Times.

Six months earlier, Trump had stunned markets by imposing sweeping "reciprocal" tariffs on nearly all trading partners. Although the economic shock was initially less severe than predicted, the US inflation rate still reached 2.9% in August.

-

Six-month change in prices of select goods as of August 2025, not seasonally adjusted. (Source: US Bureau of Labor Statistics, produced by Al Mayadeen English)

Retailers adjust to tariff pressures

Retailers have adopted various strategies to manage the trade war's fallout. Some accelerated imports before tariff deadlines, while others selectively raised prices to protect profit margins. Costco, for example, reduced its exposure by cutting back on imported holiday items like toys and decorations. Chief Executive Ron Vachris said the retailer instead showcased higher-value products such as backyard sheds and saunas to offset lost revenue.

But many companies can no longer avoid passing costs to consumers. According to a Telsey Advisory Group analysis of imported products, prices increased across 11 of 29 "soft line" categories, such as clothing and shoes, 12 of 18 "hard line" items like dishwashers and bicycles, and 5 of 16 sporting goods.

"That indicates to us that tariffs are having an impact and causing prices to go up," Telsey analyst Joe Feldman told the Financial Times.

Furniture, auto, and food industries hit hard

The world's largest furniture maker, Ashley Furniture, announced plans to raise prices across most of its catalog by between 3.5% and 12%. In a message to customers, CEO Todd Wanek cited the "significant challenges" created by ongoing tariff costs. The announcement came just before Trump revealed an additional 25% tariff on upholstered furniture, set to take effect on October 14.

Car parts retailer AutoZone also signaled further price increases. "There probably will be more," CEO Philip Daniele told analysts late last month, adding that demand for essential auto parts remains stable because "if the starter breaks, your car is not going to start."

In the food sector, tariffs on imported tin-plate steel have increased production costs for canned goods, while 50% duties on Brazilian coffee have driven coffee prices sharply higher. Campbell's Chief Financial Officer Carrie Anderson said the company had "to look at some surgical price increases" due to limited sourcing options for tin-plate.

Growing concern across US industries

An Institute for Supply Management survey highlighted tariff-related worries in multiple sectors, including food services, construction, and utilities. "Tariffs continue to inject an unnecessary level of uncertainty across the broader economy," said one real estate executive quoted in the report.

Federal Reserve Chair Jay Powell noted that, up till now, US importers and retailers have shouldered most of the tariff burden. But analysts warn this may change. Nathan Sheets, Citigroup’s global chief economist, estimated that consumers currently bear around 30-40% of the tariff cost, a share he expects to rise to 60% in the coming months.

"We think there is more to come for the consumer," Sheets told Citigroup clients this week.

4 Min Read

4 Min Read