Apple to invest $500bln in the US over next 4 years

The announcement shortly followed a meeting between Apple CEO Tim Cook and Trump last week.

-

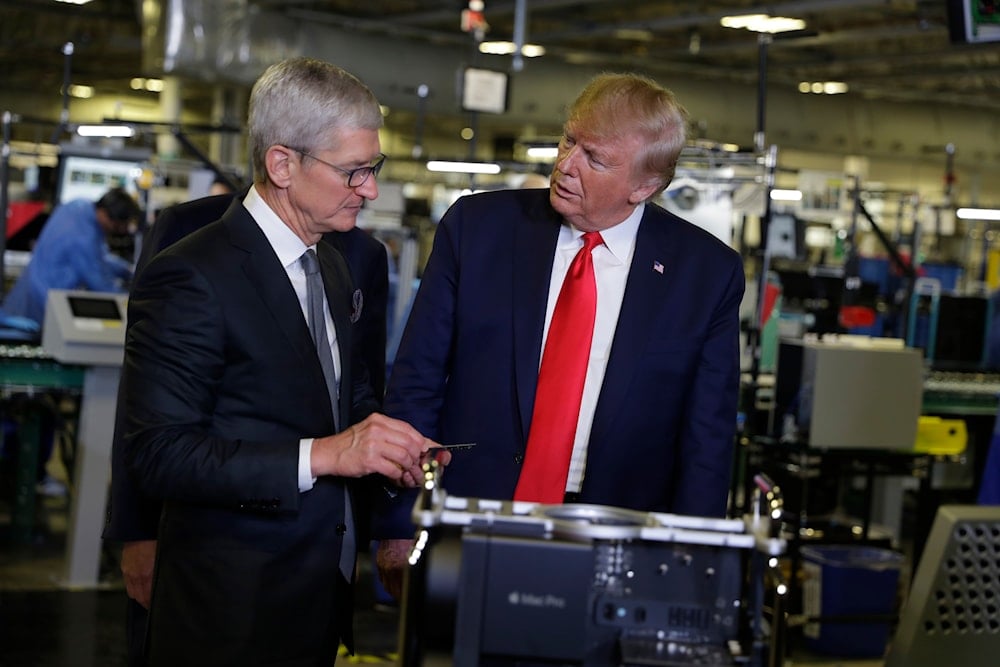

President Donald Trump tours an Apple manufacturing plant, Wednesday, Nov. 20, 2019 (AP)

Apple announced on Monday it intends to invest more than $500 billion in the United States economy over the next 4 years.

Last week, US President Donald Trump held a private meeting with Apple CEO Tim Cook at the White House, after which the former announced that Apple had plans to relocate its manufacturing from Mexico to the United States and to invest billions of dollars in the American economy.

"Apple today announced its largest-ever spend commitment, with plans to spend and invest more than $500 billion in the U.S. over the next four years. This new pledge builds on Apple’s long history of investing in American innovation and advanced high-skilled manufacturing, and will support a wide range of initiatives that focus on artificial intelligence, silicon engineering, and skills development for students and workers across the country," Apple announced in a statement.

Apple's upcoming investments include a new server manufacturing facility in Houston, Texas, doubling its Advanced Manufacturing Fund, expanding Research and Development (R&D) across the United States, and setting up a manufacturing academy in Detroit, Michigan to guide entrepreneurs in the implementation of Artificial Intelligence and smart manufacturing technologies.

United States a 'scary place to invest in'

Nobel-prize winner economist Joseph Stiglitz told The Guardian that Trump's global tariff war is turning the United States into a "scary place to invest," pointing out that the US president's economic policies could take the US toward stagflation.

Stiglitz argued that despite confidence in the US economy, Trump's tariffs and his disregard for the rule of law drive investors away from the United States warning that this risks the worst possible scenario of stagflation, adding that "if you’re a corporate in the US or in Europe, do you think you have a global market, or do you have just a European market? Where do you locate your factories?"

He also pointed out that Musk's Department of Government Efficiency (DOGE) plays a significant role due to its campaign targeting government contracts without any congressional authorization and Trump's dismissal of contracts with trade partners such as Canada and Mexico.

"The government has a huge number of contracts and we’re just tearing them up. How much risk do you want? The US has become, I would say, a scary place to invest," he asserted, adding, "I could certainly see a scenario where we get to stagflation – we get inflation and a weak economy," Stiglitz emphasized.

Trump imposes tariffs on tech and pharma

Meanwhile, US President Donald Trump announced on February 19 that he is planning to place tariffs around 25% or more on semiconductors and pharmaceuticals, shortly preceded by an announcement that he intends to impose levies on automobiles effective April 2.

Trump did not specify a date for those tariffs, but his levies on vehicles were a measure he wanted to take ever since his presidential campaign, expressing his disdain for the way Europe collects a 10% tariff on American vehicle imports.

3 Min Read

3 Min Read