Missteps and miscommunication: How the US-India trade deal faltered

A report by Reuters explains how India's anticipated trade deal with the US fell apart due to missed signals, political miscalculations, and Trump’s shifting focus.

-

A student of Gurukul school of Art completes artwork of US President Donald Trump and Prime Minister of India Narendra Modi, in Mumbai, India, Friday, Aug. 1, 2025. (AP Photo/Rajanish Kakade)

A piece by Reuters details how India and the US failed to reach a favorable trade agreement despite five rounds of negotiations and high confidence among Indian officials of securing a good deal before the August 1 deadline.

Indian officials were so confident of success that they signaled to media that tariffs could be capped at 15%. Instead, New Delhi faced a sudden 25% tariff on Indian goods starting Friday, along with unspecified penalties related to oil imports from Russia. Meanwhile, Trump finalized trade deals with Japan and the European Union and extended improved terms to Pakistan.

Based on interviews conducted by Reuters with four Indian and two US government officials, a technical consensus had been reportedly reached on most issues.

Nonetheless, the report posits that the breakdown stemmed form overconfidence, miscommunication, and India's reluctance to match concessions offered by other nations.

Key trade issues: Tariffs, agriculture, and energy imports

Indian Trade Minister Piyush Goyal and US Vice President JD Vance had exchanged visits during which India offered significant concessions. New Delhi proposed zero tariffs on industrial goods, representing about 40% of US exports to India, and committed to reducing tariffs on US automobiles and alcohol within quotas. It also agreed to increase energy and defense imports from the US, up to $25 billion in US energy purchased to bridge the $47 billion trade gap between the two nations.

Most differences had been resolved by the fifth round of negotiations in Washington. Indian negotiators believed the US would accept India's hesitancy to allow duty-free access for US farm and dairy products. However, Trump sought more extensive concessions.

"A lot of progress was made on many fronts in India talks, but there was never a deal that we felt good about," one White House official told Reuters. "We never got to what amounted to a full deal."

Why India won't open agricultural markets

Agriculture employs 46% of India's workforce and supports 450 million people from 90 million rural households. Indian farms are typically small, family-run operations that cannot compete with heavily subsidized US agricultural products.

As one Indian official noted during negotiations, there were "risks from subsidized US agricultural products" that could devastate millions of smallholder farmers.

In addition, India's resistance extends beyond economics into deeply held cultural beliefs. In Hindu tradition, cows are sacred animals, and their milk is viewed as pure and divine. US dairy operations commonly feed cattle byproducts from food processing, including animal-based feeds, which fundamentally conflict with Indian cultural and dietary preferences, particularly among the country's large vegetarian population.

Another reason is regulatory and safety concerns, as India prohibits imports of genetically modified food crops, while most US corn and soybeans are genetically modified.

Modi-Trump communication breakdown

Indian Prime Minister Narendra Modi, during his visit to Washington in February, had agreed to aim for a deal by fall 2025 and to double bilateral trade to $500 billion by 2030. However, Indian officials acknowledged that confidence surged after Trump spoke of an imminent "big" deal. This led New Delhi to adopt a firmer stance on agriculture and dairy, two politically sensitive sectors.

India also hoped to receive relief from the 10% average US tariff announced in April, in addition to a rollback of duties on steel, aluminum, and automobiles. But as Trump closed deals with Japan and the EU, India scaled back its expectations, hoping to secure a 15% tariff with fewer concessions. This fell short of Washington's expectations.

"Trump wanted a headline-grabbing announcement with broader market access, investments, and large purchases," a Washington-based source told Reuters. India, by contrast, was not prepared to match the extensive concessions made by countries like South Korea, which secured favorable terms by pledging $350 billion in investments and major concessions.

Geopolitical concerns, competing US trade deals

Negotiations were also reportedly strained by geopolitical factors like India's war with Pakistan and Indian imports of Russian oil. Trump’s comments about mediating the India-Pakistan conflict aggravated tensions, influencing Modi’s decision not to initiate direct contact. According to Reuters, one Indian official suggested that Modi avoided a call with Trump to prevent a one-sided discussion that could put India at a disadvantage.

"Trump's remarks on Pakistan didn't go down well," another Indian official remarked to Reuters. "Ideally, India should have acknowledged the US role while clarifying that the final decision was ours."

Indian officials admitted to Reuters that a lack of diplomatic support hindered progress. "We lacked the diplomatic support needed after the US struck better deals with Vietnam, Indonesia, Japan, and the EU," said a senior Indian government official. "We're now in a crisis that could have been avoided."

On Tuesday, Trump announced plans to "very substantially" increase tariffs on Indian imports beyond the current 25% and accused New Delhi of "fueling the war" in Ukraine through its oil purchases from Russia.

-

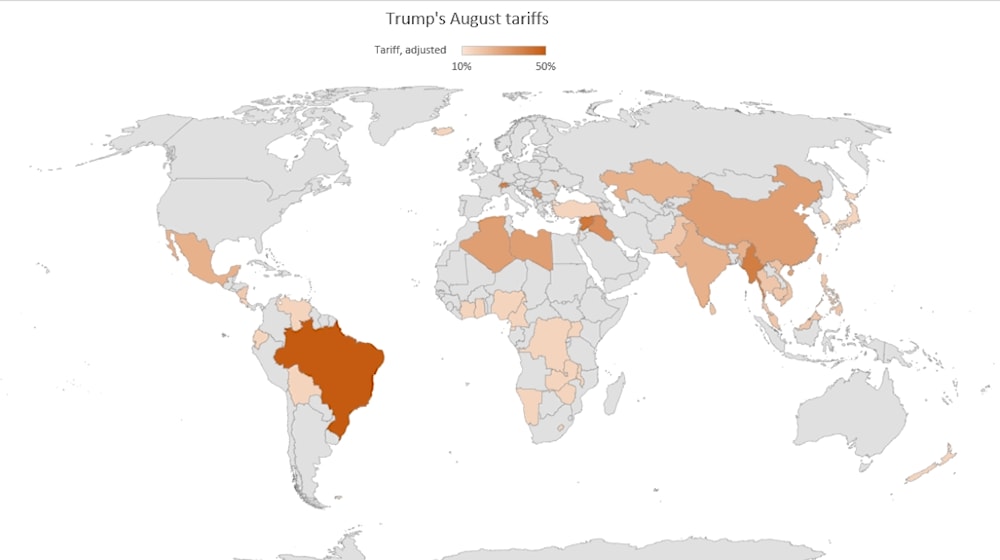

Trump's August tariffs (data sourced from the Guardian, map produced by Al Mayadeen English)

Looking forward

Despite the setback, both sides have signaled a willingness to revisit talks. A US delegation is expected to visit Delhi later this month. Indian officials remain hopeful that the India-US trade deal can still be salvaged.

Per the Reuters article, India is reviewing possible concessions within the farm and dairy sectors. Additionally, it may reduce Russian oil purchases in favor of US energy if pricing aligns.

"It likely will require direct communication between the prime minister and the president," Mark Linscott, a former US Trade Representative, told Reuters. "Pick up the phone. Right now, we are in a lose-lose. But there is real potential for a win-win trade deal."

6 Min Read

6 Min Read