Republican lawmaker proposes stamping Trump's face on $250 bill

Trump could make history as the first living US president to be featured on the country's currency if Joe Wilson's bill passes.

-

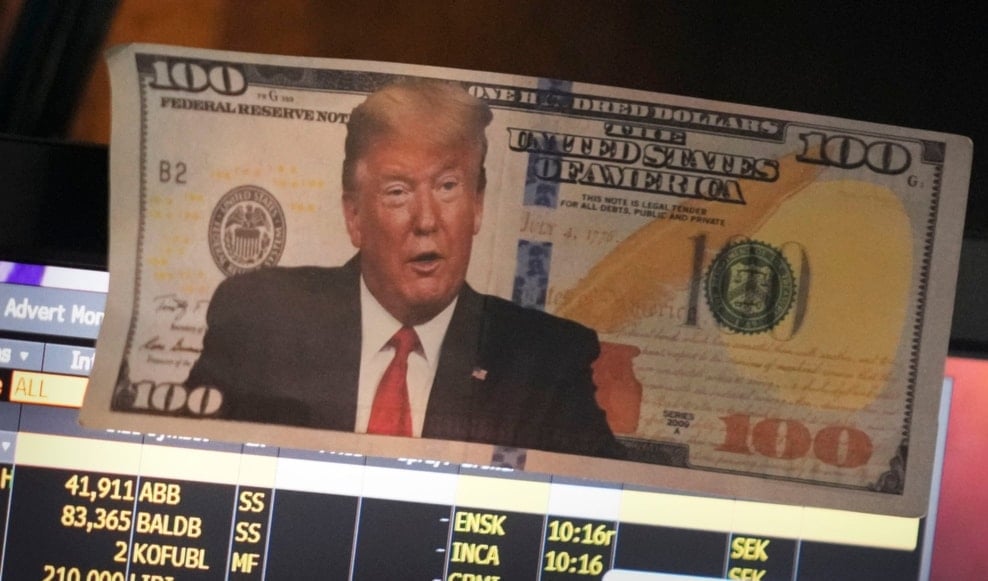

A picture of President Donald Trump on a hundred-dollar bill is displayed at a post on the floor of the New York Stock Exchange in New York, Tuesday, on January 21, 2025. (AP)

Republican lawmaker Joe Wilson announced that he is working on legislation to put Donald Trump's face on the newly formed $250 bill, which if approved, would make him the first living US president to be featured on the currency.

According to Wilson, "Bidenflation", or inflation caused under the Biden administration, forced citizens to carry loads of money, prompting the creation of a more convenient $250 bill.

In a post on X, the lawmaker described it as the "Most valuable bill for most valuable President!"

Grateful to announce that I am drafting legislation to direct the Bureau of Engraving and Printing to design a $250 bill featuring Donald J. Trump. Bidenflation has destroyed the economy forcing American families to carry more cash. Most valuable bill for most valuable President! pic.twitter.com/v4glGOB2z3

— Joe Wilson (@RepJoeWilson) February 25, 2025

A July report by The Economist found that the country's already dire financial situation is expected to worsen over the next four years as net government debt has increased from 40% of GDP in 1990 to 98% of GDP.

America has the eighth-highest net public debt-to-GDP ratio in the world, according to data released by the IMF in April. A few other developed economies rank higher than the United States. Japan comes in second place with a share of 158%. Italy comes in third with 129%.

The rate at which America's debt is accruing and its importance to the world economy make its numbers even more concerning. According to IMF predictions, the country's deficit in 2024 will be 6.5% of GDP.

Similar to most developed nations, America's debt problems started during the 2007–2008 financial crisis and reappeared in the wake of the 2020 pandemic. Apart from these crises, however, the debt-to-GDP ratio stabilized in line with the other wealthy nations in the G7. But this time, the IMF predicts that the US debt will keep growing.

In 2024, the government was projected to use $728 billion, or 16% of revenue, to service its debt. However, with an average maturity of six years, some of its pre-pandemic low-interest debts will still incur low interest rates. The cost of servicing government debt will surge as more of it is renewed at higher rates. Even in the absence of further borrowing, the interest rate on public debt will rise unless the economy’s rate of growth improves or interest rates fall drastically.

Federal Reserve chief Jerome Powell stated last February that the US national debt was on an "unsustainable" path, currently standing at more than $34 trillion, according to US Treasury data.

3 Min Read

3 Min Read